It happens to people all the time. You think you need one amount of money but soon discover that amount isn’t enough for what you need. Maybe you’ve been sick a lot lately and missed work. Now, your electricity bill is due and you have no way to pay. You get a loan to cover that bill, but the next day you receive a disconnect notice for your water bill.

Or maybe you took out a loan to cover some necessary repairs to your bathroom. And – as per usual – once you dig in you find that you need more repairs than you knew. This has happened at our house dozens of times.

How Many Loans Can You Have

For whatever reason, you now need more money than your original loan can cover, but you have no other way to cover it. What do you do? Can you even get another one since you already have one? How many loans can you have at one time?

The good news is that you can get more than one loan at a time. There is no cap on the number of loans you can get, but there are other facts that determine how many loans you can have at once. Let’s take a look.

Lender Restrictions

While there is no set number of loans you can have in total, each lender often has its own cap. In some cases, they set a maximum number of loans you can receive from them. A common cap is two loans from that lender. For some, it’s only one loan.

Other lenders have no cap for the number of loans, but they set a maximum amount you can borrow. For example, they might not loan one customer more than $10,000 at a time. However, that $10,000 could be spread over multiple loans.

Additionally, individual lenders might have other requirements. For instance, a lender might allow you to borrow up to $10,000. However, they may require that you make a certain number of payments on your first loan before applying for another.

Individual lender restrictions do not regulate the total number of loans you can have. You can apply for loans from other lenders even if you have reached the cap of an individual lender. However, there are other factors they consider, such as those below.

☛ Type of Loan

Again, there is no set cap on the number of loans you can have at once – normally. However, some types of loans are regulated.

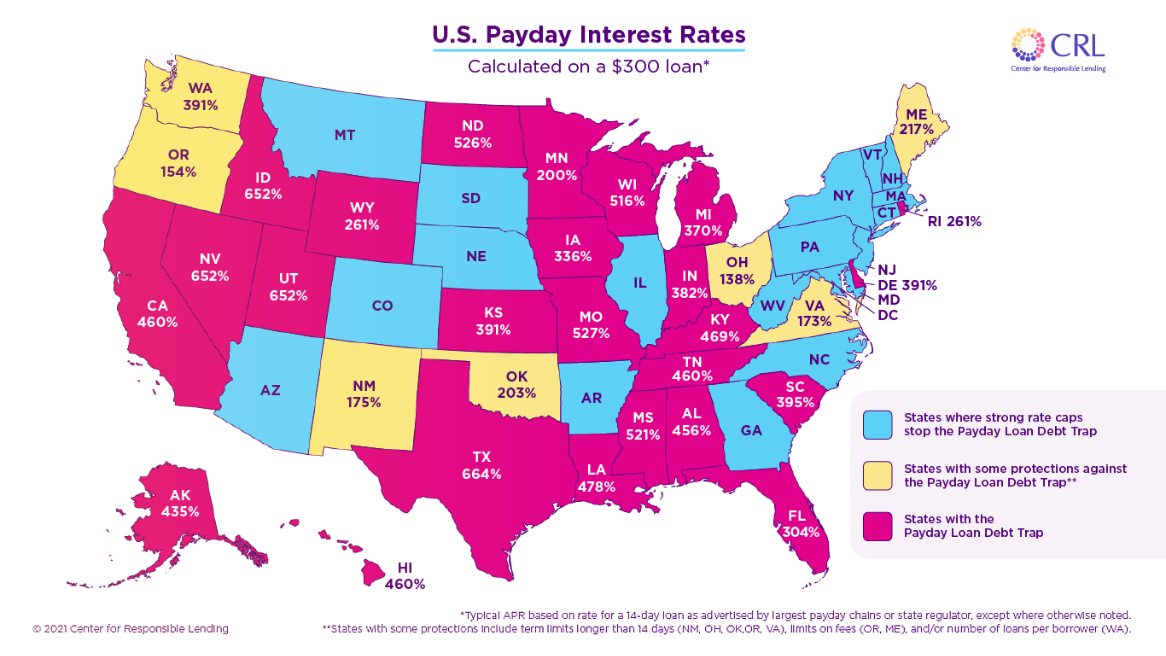

For example, payday loans are considered predatory loans and are highly regulated by law. Some states will not allow a person to have more than two or three payday loans at once.

Additionally, loans from banks are regulated. As the FDIC is involved with banks, they set a limit on how much one borrower can take out at once from that specific bank.

☛Ability to Pay

Whether you have one loan or 20, each lender wants to know that you can afford to repay the loan. This goes beyond just looking at your income.

Every time you apply for a loan, the lender will take your DTI or debt-to-income ratio into account. This means comparing how much you make to how much you owe out – AKA your debt. And this ratio can impact your approval odds quickly.

Let’s say you applied for a loan and you were approved with ease. You decide to apply for another loan a week later but are denied. Why? Neither your credit score nor your income has changed.

It’s simple. Your first loan added to your monthly debt, meaning that your DTI changed. Each loan you have impacts your DTI, and each lender has its own guidelines concerning DTI. So while there is no cap on the number of loans you can have, your DTI can prevent you from being approved.

☛ Credit Score

As with your DTI, your credit score can change with every single loan you have and apply for. Each time a lender runs your credit, it leads to a hard inquiry.

These hard hits can bring your credit down by a few points, and it can take some time for your score to rise back up. Therefore, each time you apply for a loan, it may impact your ability to get a loan the next time.

There is, however, one saving grace to this. If you apply for the loans within a short period of time – usually within two to four weeks – and it’s the same type of loan, you’ll only get one hit.

For example, if you apply for a mortgage loan through three separate lenders in one week, your credit score will only be dinged once. However, if you apply for a mortgage loan, wait a month, and then apply for a new one, you’ll get a ding for each time.

Likewise, if you apply for a mortgage loan, auto loan, and personal loan, your score will get dinged three separate times. This is the case even if you apply for all of them on the same day.

How Many Loans Should You Have at Once?

Here’s the thing: you shouldn’t strictly go by the guidelines, caps, and requirements set forth by lenders. These are just generalizations and do not take every part of your life into consideration.

In other words, just because you can borrow $10,000 doesn’t mean you should. You have to be your own financial consultant here. Before you take out several loans, ask yourself:

- Do I really need that much money?

- Do I need it right now or do I have time to make the money?

- If it is an emergency, is there any another way to cover it? (More on this below.)

- Am I able to cover my current loan easily?

- If I take another loan, how will it impact my ability to pay my regular bills?

- Will I be able to repay all of this – without sacrificing other necessities? (PB&J sandwiches are great, but eating them for breakfast, lunch, and dinner can get old quick.)

Taking out loans can be helpful, but it can also cause a lot of trouble down the line. This is especially true if you’re already having a hard time paying your monthly bills and any loans you currently have.

In short, part of the answer to, “How many loans can you have?” depends on how many you’ve applied for. If you’re going to apply for more than one loan at a time, it’s best to do it in a short timeframe. Otherwise, each ding might impact your ability to get a new loan.

If your financial situation is about to positively change, you might be okay. Going back to the beginning of this article, we talked about being behind on bills because you’ve been very sick and missed work. If this is the case and you’re now back at work, you know that your income is about to improve.

In such situations, you’d likely be okay paying a few loans for a little while. On the other hand, if you see no positive change coming to your finances soon, having several ones is probably not a good idea.

Consider Alternatives

Before you dive into another loan, consider the following options.

Work Out a Payment Arrangement

Your success at this will depend on the institution you need to pay, but many places will work out a payment plan or payment arrangement with you. For example, if you’re behind on your electricity bill, you can call the company to work out an extension. In some cases, you can do this directly on the company’s website.

Places like this might also have information on assistance programs that will help pay your bill during tough times. It’s never a waste of time to try to talk to your creditor as it can prevent the need for a loan in the first place.

Dip Into Your Savings

It might seem like a terrible idea to dip into savings, but sometimes, it’s the best option. It’s often easier and cheaper to rebuild your savings than to have to take out a loan and pay interest on it.

Cash Advance

If you have a credit card, you might be able to get a cash advance at a lower interest rate than a loan. It’s worth looking into before applying for a loan.

Debt Consolidation

This isn’t exactly an alternative, since it’s still a loan, but it is a better strategy in many cases. Let’s say that you already have a few loans and other debt. The payments you owe put you behind on your regular bills, leading you to need another loan.

Instead of getting a separate loan, consider getting one loan to consolidate all of that debt. In doing so, you can potentially qualify for lower interest and spread your payments out. Yes, you’re still getting a loan, but having one loan with better repayment terms can make it much more affordable.

Be Smart About It

If you feel like another loan is the answer for you, you want to be smart about finding it. Take advantage of the Goalry Mall, where you can compare and shop for loans, manage debt, budget your payments, educate yourself, and much more.

Conclusion

How many loans can you have? In short, as many as your income, DTI, and specific lender allow. However, you have to be wise and ensure that the number of loans you plan to take is actually going to help you – not bury you in an even deeper hole.

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.