Student loan debt is extremely high and is a major topic of conversation. With financial topics like these, they tend to be the target of scammers. At least three out of five people have received a phone call from an illegitimate company that claims they are the solution to your higher education loan debt.

Sadly, due to desperation, fear, and other emotions, many borrowers fall for the tactics of these scammers. Don’t be one of them. Below, we are going to discuss common student loan scams, how to spot them, and how to protect yourself from them.

How to Recognize and Avoid Student Loan Scams

When looking for a lender, you need to be very careful and do your research. Make sure you are choosing the best option for you. You can always look for help here, on Loanry!

Pay full attention if you want to sign up for a student loan or maybe for a personal loan for students. These are some of the most common signs of fraud that have been detected up to this point:

Upfront Fees and Monthly Fees

Most student loan scams will require that you pay upfront fees for their services or monthly fees. You will likely hear this a couple of times through this article, but it is important. Charging a fee for services does not automatically point to a scam. However, it is against the law for any debt relief help to charge fees before getting your results. There should be no upfront fees for the service at all, so if someone is trying to charge you before they do anything, run the other way.

As far as monthly fees go, they are not necessary. Understand something: You do not have to pay to receive grants or scholarships. Even if you get private student loans, you do not have to pay upfront. You also do not have to pay for things like:

- Filling out the FAFSA

- Changing your repayment plan or payment amount

- Loan consolidation

- Deferred payments

- Loan forgiveness or other government programs

Every bit of those things is free of charge. Occasionally, scholarship providers may require an application fee. This is not necessarily unusual or a scam. If you are trying to apply for one that does ask for a fee, look into the scholarship first. Your school should be able to help you do this. A simple Google search can usually find pertinent information as well.

As far as any current student loans go, you can handle any business you need to directly with the loan service provider. My student loan service provider has an excellent website- as most of them do. I have the ability to change my payment plans, apply for an income-driven repayment plan or other plans, and more. I even have the ability to choose which of my loans get my payment if I want to pay a different one than the one they have placed as first in line.

And if I have any questions, I can contact them directly through the website- no middle man required. Don’t pay for something that you can do yourself for free. And do not be fooled into thinking you cannot do it yourself. Take a look at StudentLoans.gov, too, for anything related to federal student loans.

Aggressive Sales Tactics and Urgency

Everyone I know has experienced the tactics of a salesperson. They push and push and push to get you to buy. They make you fear missing out on a deal so you hurry and sign up immediately. The harder they push, the more you know that their paycheck probably relies on the commission from your purchase.

Unfortunately, student loan scams tend to be worked by experienced salespeople. They know what to do to push you into a decision you probably would not make otherwise. If you feel pressured to sign up, take a step back, and look into the company.

Improper Grammar and Spelling

Grammar and spelling mistakes are not all that odd. It is easy to accidentally press a “T” instead of an “R” on your keyboard, or something similar. It is also not unusual to get so caught up in your writing that you type “your” when you mean to type “you’re”.

While everyone can make an occasional spelling or grammar mistake, many communications from companies that pull student loan scams contain a good deal of them. It is not always the number of errors, though. Sometimes it is the errors themselves. Unusual errors are a good sign that the company is fraudulent.

Most legitimate companies have fewer errors. This is because many of them have a spell check program on their computers. They also tend to actually double-check their work.

Don’t get me wrong- bad communication does not necessarily mean that it is one of the student loan scams. Even those of us who write for a living like me make mistakes and do not always catch them. These mistakes are more of a red flag than a full stop sign. If you receive a communication like this, take a beat and check into the company.

Asking for Authorization

A lot of companies committing student loan scams ask for things that they have no business asking for, such as your social security number, your FSA ID, your sign-in information on your loan service provider websites, or even for you to sign a power of attorney agreement giving them the power to “negotiate” your accounts. Please pay attention: No legitimate source of student loan help will ask you for any of that information. If you give these scammers any of that information, you could end up in a lot of financial trouble. You absolutely never know what they will do with it.

If messing up your finances is not scary enough, think about all of the information that your student loan service providers have: Your identifying information, any income verification you turn in, family information, your home address, your telephone number, credit card information, and more. They can use this to steal your identity, clean out your bank account or credit accounts, and more. And, let’s just be honest, there are stalkers and others out there who might use your home address for other reasons. So, do not give out this information.

The Threat of Legal Action

Have you ever received one of those phone calls that tell you if you do not take immediate action that day, a law enforcement officer will be at your house that afternoon? I have, and the first time, I was scared to death. Fortunately, I had missed the live call and heard this threat on my voicemail, so I did not have to respond to a person immediately.

Instead, I searched my brain for anything that would warrant such action and finally called a friend to share my fear. Turns out, she had just experienced something similar and told me that it was a scam. After no law enforcement officer showed up at my house that afternoon- or any afternoon thereafter- I realized that she was right.

People that scam others play on their emotions. One of those emotions is most definitely fear. If they can make you afraid enough to believe that you will be in jail, there is a good chance you will do what they ask. Let’s alleviate some fears, shall we?

I cannot think of one single civil or consumer debt that you can be jailed for in America. If any debts can put you in jail, it is those such as unpaid taxes or unpaid child support. However, even those do not typically put you in jail automatically. There are court proceedings and warnings and a process.

Additionally, you do not get phone calls for stuff like that- unless it is from a lawyer you hired. Courthouses do not call. They send out official letters, usually dropped off by an official delivery person or process server.

Other debts, however, like credit cards, loans, and such do not put you in jail. They can ruin your life in ways like keeping you from getting credit, buying a home or car, getting good interest rates, and possibly even getting certain jobs. Imprisonment is a totally different story.

Affiliations

A lot of companies running student loan scams will claim to be affiliated with the Department of Education. While the Department of Ed does work with some companies, most companies that claim an affiliation are lying. You can look at the Department of Ed’s website to see what trusted companies they work with, but remember, you are not required to pay for help with student loans. If someone is trying to charge you, know that you have many free options.

Common Student Loan Scams

The number of student loan scams in play will likely continue to grow over time. And they will probably get more and more creative. Don’t let them fool you and don’t think that you will save money on your student loan with their loan options. For now, though, there are some common ones to look out for:

A Stop in Your Loan Forgiveness

Scammers use fear and urgency to get results. If someone calls you or sends you a notice that your loan forgiveness is about to end, ignore it unless it is straight from the Department of Education or your loan service provider. If there really is going to be a change, one or both of these two organizations will send you an official notice.

Additionally, even if the government decides to make changes, it will not happen overnight. Things like that take time to move through all parties that must agree on them. It also takes time for things to be put in place. So, if there is going to be a change, you will know about it way ahead of time- not a few days or a few weeks beforehand.

Total Loan Forgiveness

One of the most common student loan scams is when companies offer total or fast loan forgiveness. There are a couple of things for you to know here. First, only special circumstances can completely discharge your student loans. This tends to be things like:

- Death– and no one wants to die to avoid student loan debt

- Disability– not a temporary disability but extreme and permanent disability

- Bankruptcy– in some very, very rare circumstances

- Public Service Loan Forgiveness and Teacher Loan Forgiveness– for borrowers who work in certain job types for a specified amount of time

The second thing to know is that none of these circumstances can get your loans discharged quickly. They all require a certain process and can take up to years to work fully. Companies claiming that they can do this for you are committing student loan scams- stay away from them. If you feel that you qualify for student loan forgiveness, you can speak to your loan service provider about it.

Loan Repayment or Loan Debt Relief

If a company claims that they can settle your debt for lower than anyone else or that they can get you a special deal, it is not true. While debt relief companies can help you settle your debts for lower than the original amount, they cannot get better results than you or any other company can. If you choose to use a debt relief company, that is up to you. However, do not hire a company over because of an untrue guarantee.

Taxes

The Better Business Bureau warns of another of the popular student loan scams: Federal student tax. Scammers call unsuspecting borrowers claiming to be IRS agents or even FBI agents saying that they owe a federal student tax. This scares borrowers into paying these scammers to stay out of legal trouble. Here is what you need to know:

- There is no such thing as a “federal student tax”. This is a completely made-up term

- If you owe the IRS for anything, you will receive an official notice– not a phone call

- The FBI does not collect debts, and they certainly will not call you asking for money to do such. If any legitimate agency needs to contact you, they will send official notices or show up at your door with official badges. Even then, you can make calls to verify their identity. The FBI is no stranger to scammers, so the legitimate organization will have no issue with you verifying someone’s identity. But again, they are not debt collectors, so if someone shows up or calls about your debt, hang up or shut the door

Reduce Your Risk of Being Scammed

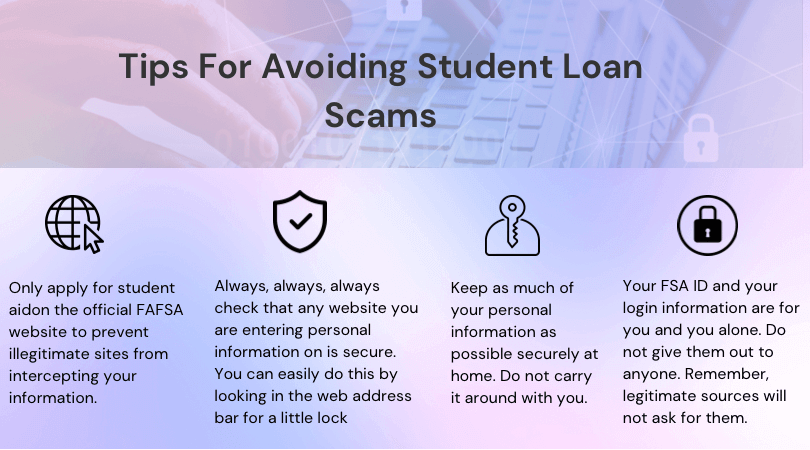

- Only apply for student aid on the official FAFSA website to prevent illegitimate sites from intercepting your information. After completing the application, completely close out of your browser.

- Your FSA ID and your login information are for you and you alone. Do not give them out to anyone. Remember, legitimate sources will not ask for them.

- Keep as much of your personal information as possible securely at home. Do not carry it around with you.

- If you feel you have given your information out to any illegitimate source, reach out to the supplier of that information- such as your student loan service provider, your credit card company, and so on. And immediately change any login information and passwords, cancel credit cards, and take any other precautions you can. The quicker you make these moves, the better chance you have of stopping trouble before it starts.

- Always, always, always check that any website you are entering personal information on is secure. You can easily do this by looking in the web address bar for a little lock. If it is there, the website should be secure.

Companies Known for Student Loan Scams

There are several companies that are known for student loan scams. Unfortunately, these scammers often simply just open up under another name. However, the FTC does share a list of companies that are known for student loan scams here, so be sure to check it out.

Conclusion

While organizations do work hard to prevent scammers from succeeding, it is up to each one of us to protect ourselves and our families. Learn all you can about scams as they are outed so you know what to look for. Above all, remember that if you need any help with your student loan debt, you can go straight through your loan service provider or the federal government for help.

If you are contacted by what you feel is an illegitimate company, report it so that others can be made aware. You can do this through your loan service provider, the FTC, or your state attorney general’s office. These complaints are taken seriously and you can trust that they will be investigated.

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.