You know you are now ready to get married. But your wallet is not. What will you do? should you opt for a personal loan or use your credit cards for wedding expenses? If you have existing loans, you have to reconsider your options. A budget calculator can help you manage your finances to determine whether a credit card wedding financing or a loan is what you need.

Let us check the pros and cons of wedding loans versus using credit cards.

Using Credit Cards for Wedding Expenses

If you have a credit card, it means that your bank is giving you a pre-approved loan. You can use your credit card to finance your wedding. It comes with a credit limit that you can maximize to your advantage.

Here are some ways to maximize your credit cards for wedding expenses.

Look for a Wedding Planner Service Provider that Accepts Credit Card

To take advantage of your credit card wedding finance, purchase wedding necessities at 0% interest. You can also use a wedding planner service coordinator that accepts credit card for payment. If they don’t offer an installment plan, you can check with your bank.

Wedding coordinator providers now know the challenges associated with skyrocketing wedding cost.

Check for Credit Card Promotions that Your Bank Offers

Promotions like 10% on wedding cakes or 10% discount on a wedding dress from your mall’s department store can mean savings on your credit cards for wedding expenses.

Check for tiered promotions where you can get possible discounts for hotel rooms. Look for a hotel that offers a 10% discount if you use a certain credit card like Visa or MasterCard. Now you got a place for your honeymoon.

0% Interest Rates Credit Cards

Take advantage of your card if there are 0% interest rate offers. 0% interest rate means you can pay and have it on installment without interest. Installment plans can be up to 48 months at 0% interest.

Cashback and Rebate With a Minimum Spent

Most credit card companies and banks offer cash back and rebates. For example, you can get a $50 rebate if you will spend a certain amount with your card. You can also get points that can be converted to cash.

Your research skill can help you find cash back and rebates. You can also call your bank and check what they currently have for promotions.

Earn Reward Points

With a good credit card, every time you swipe your card means spending. As you rely on your credit card wedding finance for expenses, know that you are also earning points. Robust reward points can be converted to big savings too.

For example, there are credit cards that can give you 1000 reward points every time you spend at least $1000. The said reward points can be converted to something else like cash. You can also convert it gift checks.

Taking a Personal Loan for Wedding

Wanting to spend on your own wedding is admirable. It is what adults do. It is called taking responsibility. And with your big day coming, you would want to prove that you can. With a limited budget, one thing you can do is to take a wedding loan. A wedding loan is a personal loan that you can allot for your wedding expenses. We don’t recommend going into to debt for your wedding, but some people say I do. We always recommend saving on your wedding before getting a loan or using credit cards for wedding expenses.

Here are the types of personal loans that you can take:

Bank Loan

Taking a bank loan is easy if you have a good credit score. The interest is also low as compared to other creditors. However, before you can take a bank loan, you should consider the following:

Interest rates

How much is the interest rate? Can you afford it without going bankrupt? Bank loan interest rates depend on your current score standing and the loan amount you are trying to get.

How to Get Low Interest Rates

Don’t limit yourself with the nearest bank in your area. There are numbers of banks that offer bank loan with low-interest rates. What you can do?

- Do your research about the different bank loans offered near you

- Don’t limit it to banks near you, check online as well

- Choose the best three banks, choose the right one for your needs

What to prepare to get low-interest rates

For bank loans, the interest rate will depend on your credit score and the terms payment selected. Start your preparation by checking your current credit score. If it is poor, find a way to at least make it average. Pay old debts if you can. Consolidate your credits. Once you have a better credit score, you can enjoy a more flexible bank loan interest rate.

Terms of payment

Most banks offer easy installment payment when offering loans. Depending on your current financial status, choose the term that will work for you.

6-month payment term

A 6-month wedding loan is highly advisable because it has the lowest interest rate. Remember, the longer the terms of payment are, the higher the interest rate will be.

12-month payment term

If you cannot pay it immediately, go for a yearlong installment plan.

24-month payment term

Most banks offer two-year bank loans, and this is good if you are not seeing any potential financial setback in the future.

48-month payment term

You can go for a longer wedding loan term if it will positively affect your financial status. You might not want to start your first one-to-two-years of marriage life paying the debt. Still, if it helps in managing your finances, you can go for two years. There are banks that offer 3 to 5 years payment terms as well, just choose which one will work best for you.

What is the best payment term?

The best payment term is the one that will work with your current and possible future financial status. Don’t get a short-payment term if you won’t be able to pay it. It can be stressful to your marriage life if you will be faced with financial problems in your first months.

Secured Loans

If you don’t want to use your credit card for wedding expenses like on wedding ring financing or wedding gown, a secured loans might help. Secured loan is easy to get with collateral regardless of your credit score.

Before getting a secured loan, consider the following factors.

Interest rates

A secured loan are easy to find. However, the interest rate is hard to accept. If you are going to take a secured loan, make sure that you have computed the interest rate in advance to determine if really helps or not.

Terms of payment

Most secured loans have short terms of payment. It can be 1 to 3 months. Failing to pay it on time also means paying a penalty of the outrageous amount.

Loans With a Guarantor

You can get a loan with a guarantor from individual creditors. These are people who do it as their personal business. However, it is hard to get a loan from them unless someone they knew acts as your guarantor.

Interest rates

The interest rate from individual creditors ranges from 5% to 20% of the principal amount.

Terms of payment

The good thing about personal creditors is flexibility. You can ask them to give you a good term of payment that banks or secure loan creditors don’t offer.

Taking a Loan From a Friend or a Family Member

A wedding is such a joyful event. You might find your family members offering financial help at your wedding and it is okay. Offer to pay interest. Ask for good payment terms.

Interest rates

Asking help from your dad might be easier if you are getting married especially if you have a bad credit score. You can show gratefulness by offering to return it with an interest in their liking.

Terms of payment

With a loan from a friend or a relative, you can also haggle in terms of making a payment. I know a friend who is paying our other friend quarterly for his wedding loan. If a friend offers financial help for your wedding, take it, just make sure to pay it as agreed.

Is It Possible to Avoid A Wedding Loan?

If you have enough savings, yes you can avoid a wedding loan. However, would you drain your emergency fund just to get married? It is still best to use your credit cards for wedding expenses or take a personal loan. This way, in case something happens, you ‘ll have your emergency fund to use.

If getting a wedding loan is inevitable, you can still at least reduce the loan amount. Here are some tips that you can do to minimize your wedding expenses.

Plan and budget

Overspending happens when you keep on buying stuff that is not needed. To make your expenses clearer, you can start by planning. Sit with

your partner and start making a list.

For your wedding loan, you can decide on the amount based on your plan and checklist. Avoid taking more than what you need. Applying for a bigger loan means paying a higher interest rate.

Use your credit card as much as possible

If you have a credit card with good standing and high credit limit, use it for your wedding as well. You can take advantage of your credit card offers and promotions. That way, you can avoid taking a payday loan. Using your credit cards for wedding expenses is much better than taking out a loan in terms of interest and payment scheme. If you cannot pay your credit card bill the following month, request for consolidation. This way, you can have your credit card wedding finance be paid in installment.

Reducing Wedding Expenses

If you are trying to avoid getting a wedding loan, start by reducing your wedding expenses. Among the things that you can change or modify to save are:

Make your wedding ceremony more intimate by inviting a few important people only. Make sure your families are there and your best friends. There is no need to invite your grade school teachers or your neighbors from 20 years ago.

A church wedding can be expensive. Instead of exchanging vows on a church, have your wedding ceremony at a park. If you are near a beach, do it on the seaside. It can turn the atmosphere more romantic and solemn.

Having a 5-course meal can be impressive. It is also expensive. If you have family members that can cook well, why not ask for their help. Pay for a resort or place where you can have the reception. Bring in your own caterer. This way, you can personally select the menu while at the same time saving on cost.

Most women might want to have the best wedding dress. But you only wear it once. If you can find a great rental wedding gown, consider it. You can also check thrift stores for vintage wedding gowns.

If you have a friend that takes a picture like a pro, ask him to cover your wedding. If you have a friend who is good with makeups, ask for help. You can save a few hundred dollars to a thousand if you have friends that can help you.

You got a friend who can DJ? Why not ask him to man the floor after the wedding ceremony? In addition, if you have creative and artistic skills, you can also make your own souvenirs instead of buying.

Indeed! A lot of women want to be a June bride. For some reason, June or summer is the favorite season to get married. During this time, expect wedding cost to be inflated. Wedding venues are expensive as well as catering services. Wedding planner service providers are hard to find as well. If you can, pick a date that is close to both of your hearts. It can be your anniversary or birthdays.

How to Prepare for The Big Day?

Not everyone can get married. Not all couples who want a ceremony gets it. If you have plans to get married, you can start by looking at your current financial situation. Do you have any savings? Or an emergency fund? Do you have good credit score in case you need to borrow? Do you have families that can help you?

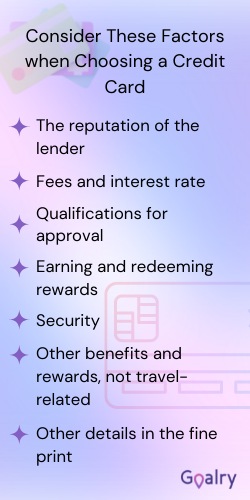

Find the best credit cards in town. Do your research. There are credit cards that are generous in awarding rebate points. There are credit cards that are always offering 0% installment promotions.

Build a good credit reputation to increase your credit limit. Overall, build a good reputation as a credit card holder. If you need to request for reimbursement like annual fees, your credit card provider can grant your request.

Know what you need to prepare. Know their requirements and terms. Is it doable? Can you borrow and be able to pay it on time? Taking a bank loan if you have a good credit score is easy. if you have bad credit, you might find it more difficult to get approval. Unlike credit cards, you can use credit cards for wedding expenses until you reach the limit of your cards.

If you are currently working on a day job, find another source of income. You can opt for online jobs that pay well. You can start a small business. Talk with your partner on how you can grow your money until you decide on a wedding date. Above all, start saving for your big day. Reduce your date nights and drink nights. If you can watch movies at home, do so. subscribe to Netflix rather than watch at cinemas weekly.

Conclusion

Rather than taking a wedding loan, you can also use your credit cards for wedding expenses. Credit card companies offer different promotions that you can take advantage of. It is like applying for a loan but with different perks. It is easier to use as well, just swipe it.

With a credit card, you can start purchasing a wedding dress, shoes, gifts, and souvenirs. You can also work with a wedding coordinator service provider that accepts credit card for payment. While spending, you are also earning reward points and rebates. Once you maxed out your credit card, you can have your balance consolidated or request for a balance transfer with a more flexible term of payment.