Buying a car is not something we tend to do often. Well, most of us anyway. We all have that friend that seems to get a new car every year. But, that is not the norm. Many of us dislike shopping for cars. I certainly do. They are expensive and you never feel like you are getting a good deal. We all know that the minute we drive the car off the dealer’s lot, the value begins to decrease. Cars are a necessary evil. We need them to get to work and handle our every day needs, like shopping. When shopping for a car, the price you pay is important. How you finance the vehicle is equally important.

I am going to give you all the information you need about getting money to pay for a car, including good credit auto loans. Keep reading for everything you wanted to know, and probably some things you do not about auto loans.

What Is An Auto Loan?

An auto loan is a bit different from a personal loan. You can get an auto loan from a bank, credit union, or financed through the dealership. Typically, when it’s financed through the dealership, the car maker, Honda for example, is financing the loan. These are considered secure loans as the vehicle you are buying is collateral for the loan. That means if you do not pay the loan, the lender can and will repossess your car. They technically own the car until you pay off the loan.

Another point to consider is when you have an auto loan, the lender makes you have full coverage auto insurance. You do not have a choice on any other type of coverage. They want to ensure the car is fully protected in the even of an accident. After all, they have a stake in what happens to the car as long as you are paying back the loan.

Good credit auto loans tend to have lower interest rates. Since the car you are purchasing becomes collateral, the lender is not taking as big of a risk by lending you money. Auto loan repayment schedules can be longer than a typical personal loan. You can take up to seven years to pay back some auto loans. This can help to reduce the amount you pay back per month. However, that does mean you are paying on the loan for seven years and therefore stuck with the vehicle.

What is an Interest Rate?

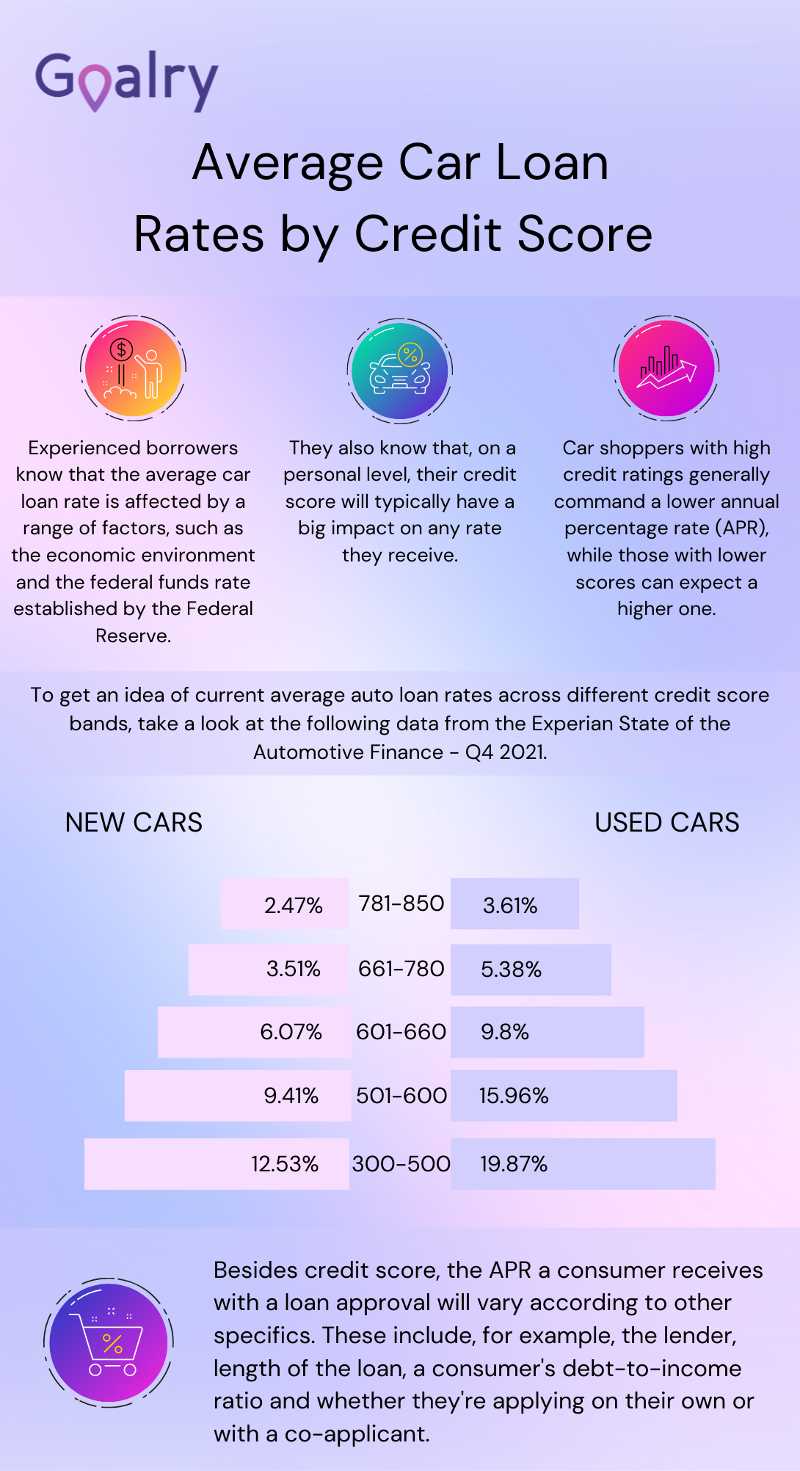

The simple answer is interest is the fee the lender charges you to let you borrow money from them. The way interest impacts you is fairly simple, too. The higher the interest rate is for your loan, the more money you ultimately pay. The lower your credit score means the higher your interest is. Some things to know about interest are that the actual amount you want to borrow is called the principle.

The interest rate is added on top of the amount you borrow. Lenders add interest at a higher interest rate to loans they consider high risk, such as to those who have bad credit. Loans that are lower risk are given a lower interest rate. It is better to get good credit auto loans so you can have a lower interest rate.

Let me Give You an Example to Highlight This

Please keep in mind, these are just examples meant to highlight the difference in interest rates. These are not real world numbers.

You want to borrow $20,000 for a car. You have good credit, so the lender adds 5 percent interest. And you would like the payments to be a little lower, so you opt for a 48 month, or 4 year, repayment period. 5 percent of the $20,000 you borrowed is $1,000.

Remember, the principle amount is $20,000 + $1,000 interest = $21,000 you are borrowing. Your monthly payments are $437.50. That is $21,000 divided by 48 months.

The Same Situation But with Bad Credit

You are borrowing $20,000 but your credit is bad, so the lender adds 15 percent interest to your loan. 15 percent interest equals $3,000. So, you have a principle of $20,000 + $3,000 interest = $23,000 total. Your monthly payments are $479.16. That increases your monthly payment by about $50 per month. That may not seem significant to you, but keep in mind the more the car cost, the more that difference is per month.

Does My Credit Make A Difference For An Auto Loan?

It sure does. I highlighted above how a lower credit score costs you more in interest charges. There are other ways your credit score impacts your ability to obtain loans. Your credit score impacts a lot more than just loan eligibility. It can stand in the way of you getting insurance, a house, and even a job. Your credit score directly impacts so many things in your life. As a result, it is important that you understand what it is and how it works. Obtaining all the information you can helps you protect your credit score and allows you to find good credit auto loans.

A typical credit score range from 350 to 850. Most people have a credit score somewhere between 600 to 750. Good credit falls somewhere between 670 to 800. Anything below 570 falls into the danger zone of bad credit. When you have bad credit, it is much harder to get a good interest rate. You may find it is difficult to be approved for a loan. Lenders feel those with bad credit scores may not be the best candidates for loaning money.

Consider an Online Loan

These types of auto loans are much faster because the application is completely online and it takes only minutes to fill out. Anything documents that are needed, you can upload in the same space where you filled out the application. Typically, you find out if you have been approved in about 24 hours. The money is in your bank account within 24 hours of your approval.

Online loans have really simplified and sped up the loan process. The slight downside to online loans is that they tend to have higher interest rates. In the past, they were considered loans for those with bad credit, but that thought is beginning to change. One thing to which you should pay attention when it comes to online lenders is shady lenders. There are always people looking to scam others, so be careful. Find out everything you can about any online lender you are considering. Make sure they are certified to lend in your state.

Can I Use A Credit Card To Buy A Car?

Yes, typically you can use a credit card to buy a car. There are some restrictions based on the particular dealership or car. Some dealers may not allow you to use a credit card for the purpose of buying a car. When a credit card is used, the merchant or dealer, in this case, has to be a fee. That fee is typically about 1 to 3 percent of the purchase cost. Many dealers do not want to pay that fee on the sale of a vehicle. A dealership can make more money when you finance a car through them instead of paying for it in full.

You should also consider that just because you can use a credit card to buy a car does not mean that you should. A car is expensive, so you are putting a lot of debt on your credit card. If your credit card has an interest rate and you cannot afford to pay the balance in full, you could be hit with hefty interest charges. Those interest charges may be higher than if you applied for good credit auto loans. If you have a credit card that is offering 0 percent interest and you have a high enough available credit available, it may make sense to use a credit card.

However, if you are not able to pay off the credit card before the special interest ends, you could be hit with all of those interest charges anyway. It could be a hit to your credit initially, if you use a credit card to pay for a car. And it will increase the balance you are carrying on your card. It increases your debt to income ratio. This things can negatively impact your credit.

How Does My Credit Card Work?

Before you seriously consider using a credit card to pay for a car, you should understand how credit cards work. I am going to run down some basic credit card information for you. A credit card is a plastic card that has your name and credit card number on it. It has a magnetic strip on the back and a chip on the front. You can either swipe the card, or insert it so the chip can be read. When you swipe or insert the card into a merchant’s machine, it can read your name, account information, and other pertinent information to determine if your purchase is approved.

The bank gives you a credit limit and you cannot borrow beyond that limit. You can pay off the amount you borrow by a specific date each month. If you cannot pay the full amount, there is a minimum payment you must make. Any amount that you do not pay is subject to interest charges. If you do not make the minimum payment or make the payment late, the bank assess a fee. Only paying the minimum amount or getting hit with a lot of fees puts you in a dangerous place. You may run the risk of drowning in debt and need credit card refinancing. You may hear terms such as simple credit card or apr credit card. They really are the same thing.

When you use the credit card, that decreases the amount available to you. As you pay off the amount you owe, that increases the amount available to you.

I Will Give You an Example to Illustrate How it Works

Your credit limit is $2,000.

You purchased $500 worth of items. Your credit limit is currently $1,500. Your minimum monthly payment is $25. You owe $500, but can choose to only pay $25.

If you only pay $25, you still owe $475 and will pay interest on that amount. But if you pay $500, you owe $0 interest. If you pay $500, your available credit goes up to $2,000. If you only pay $25, your available credit is $1,575.

Which Is A Better Option: Personal Loan or Credit Card?

We have talked a lot about different ways you can purchase a car. So what is the best way to get good credit auto loans? Should you even get an auto loan? It comes down to what is best for you at this moment in time. That answer could change for you as time progresses. Since you cannot predict the future, you have to do what is best for you at this time.

One of the major differences between and credit card and a loan is the variable payment. When you obtain a loan, you know what your payment amount is for each month. The interest rate is set and the amount of time you have to pay back the loan is set. As a result, your monthly payment is set. You know exactly what you have to pay. You can pay more each month to pay off the loan early, but you do not have to.

When it comes to credit cards, the amount you owe each month is directly related to the amount you spend. The upside to this is you are only paying for exactly what you use. The down side to this is it is hard to budget how much you must pay each month when it is constantly changing. Often the interest charges on a credit card are higher than that of a personal loan. There are some exceptions, such as a credit card with a special 0 percent interest program.

As I have mentioned a few times above, there are many options available to you. I want to highlight the benefits to good credit auto loans. When you have good credit, there are many more options open to you. You can obtain a personal loan with a lower interest rate. This translates to major savings to you. You pay less money per month when you pay back the loan. It is easier for you to find a loan that has terms that fit into your budget. You are better able to budget your loan payment because the payment amount stays the same each month. There is no fluctuation to the amount of money you pay from month to month. If you take out a personal loan, it does not impact the balances on your credit card. You can still keep that available to your for emergency purposes or other uses.

In addition to good credit auto loans, you can also consider using a credit card to purchase a car. Some of the advantages to using a credit card are you only pay back the exact amount you use. Instead of taking out a loan for a set amount, your credit card has revolving credit. When you pay off what you used, the credit is available to you again. This mean flexibility in how you use the card, but it also means that your payment amount is variable also. Since you pay only what you use, when you spend more money on your credit card, it increases your payment.

Another positive to credit card is that many of them offer special promotions and reward programs. You may be able to find a credit card that is offering 0 percent interest on all purchases for a certain period of time. Other cards offer money back or points on certain purchases. Some of those points can be used for discounted airline tickets, or savings on other types of purchases. When you use a credit card to purchase a car, you are not technically taking on more debt. You already have the revolving debt from the credit card. You are not applying for additional debt on top of that current debt.

Which Is The Best Credit Card?

As noted above, good credit auto loans are not your only option. There are many credit card options available to you. With so many options, how do you know which is the right one?

There are a few things to consider when deciding on which credit card is right for you. Spending a little bit of time up front can save you a lot of money in the long run. Credit limit is important to you. If you have a low credit limit, it may not be useful to you. If you plan to make large ticket item purchases, it will not be long before you are maxed out. So, if you know what you plan to do with your credit card, that can help indicate how much credit you need.

Interest rate is also important. This is especially important if you carry a balance. When you do not pay off the balance of your credit card each month, you pay interest charges. The lower your interest, the less you have to pay. It may not seem like the interest is a big deal but that extra money adds up when you are trying to pay off a credit card. Try to find a card that offers an introductory period of 0 percent interest.

Pay Attention to Any Fees the Credit Card has

Most credit cards will charge you for paying late, or missing payments. You should know up front how much that will cost you.

Also, some credit cards have annual fees, but many do not. This is a fee you are charged every year simply to be allowed to use this credit card. Look for a credit card that does not have an annual fee.

Many credit cards offer rewards, so pay attention to that. If the credit card offers a reward, make sure it is one that makes sense for you. If you are afraid to fly and have never been on a plane, a credit card that offers discounts on place tickets probably is not the best one for you.

Conclusion

I have given you a lot of information about good credit auto loans and your options. At the end of the day, you have to do what is best for you. That might mean waiting a little while for a car. Maybe that means adjusting your budget and saving some money. Or it might mean going out and finding good credit auto loans to get that new car you want.

Julia Peoples is a long-time business manager focused on providing decision making assistance to the public. She works with people at key points of their lives who are making important retirement and financial decisions. She has had many articles published that educate the public on sound financial decision making.

Julia writes for those who are working towards financial freedom or a better understanding of how finances work. She has shared her financial insights with individuals on a one on one basis for years.