A decade or two ago, the answer would have seemed simple. How to pay for college? Student loans! Take out as much as you can from as many places as possible. And defer repayment for as many years as you can get away with! By the time you have to make your first payment. You’ll have a great career and tons of money and you won’t even miss that monthly installment! Unfortunately, it didn’t always work out quite that way. That’s why we’re reviewing all your options below.

Save Up Ahead of Time

Obviously, it’s ideal if you’re able to start separate savings account well ahead of time, whether the student is you or your offspring or anyone else for whom you’re responsible. Keep in mind that even a few thousand dollars can make a huge difference when it’s time figuring out how to pay for college. In addition to tuition, there are application fees, textbooks to buy, on-campus housing, and endless other expenses to consider. The ability to pay for many of these peripheral costs out of savings simplifies things considerably. And the less you have to borrow, the better.

Grants and Scholarships

Everyone knows that grants and scholarships are amazing, primarily because you don’t have to pay them back. The trick, sometimes, is finding them. They come from so many different sources. And because they’re often privately funded and target specific schools, demographics, majors, or other factors, there’s no one source for locating all for which you might qualify.

That does not mean, however, that you should ever, ever, EVER pay someone to look for grants, scholarships, or any other sort of financial aid for you. There are no secret codes for tracking these things down – no private databases or inside tracks. Every possible bit of information related to financial aid is free for the asking, and that’s how it should stay.

I’m going to assume you’re already familiar with the FAFSA. It’s your one-stop ticket for anything offered through state or federal government or the college or other post-secondary institution of your choice. The FAFSA acts as an informational tool for schools you’re considering, so they can help you with options. And a sort of universal student loan locator – at least when it comes to traditional student loan options.

You should always complete a FAFSA early in the process, however you plan on paying for school and whether you expect to qualify for aid or not.

The stuff that we’re talking about are things like that $500 scholarship your parents’ church offers for anyone going into the ministry, or the $2000 a local Native American group has available for anyone who can establish tribal membership or money from a local industry to support students pursuing training in electronic engineering or plasma physics or arts and crafts. Whatever it is they need more of but can’t find enough of.

Start with your (or your kid’s) high school counselors or the college and career office in your district, if such a thing exists. You may find tons of excellent information, or you may be handed a few generic brochures or pointed to a website or two. They may be totally confused as to why you even asked. That’s OK, though, because it was worth asking. Sometimes those high school counselors are a gold mine.

Next, talk to the financial aid offices at your top 2 or 3 choices for where you’d like to attend. Find out what connections they have, what they know about, what they suggest. Your chances are much better with this group. Since they don’t make money unless you come to school there, and coming to school there means finding a way to pay for it. Try everything they suggest, whether it makes sense to you or not. No matter how successful, or not, we’re not done.

Go to your local library and tell them what you’re looking for. Once again, you’ll often hit gold with this option. But it depends on who answers the phone or who’s at the desk. If you don’t get satisfactory responses the first time, try again during a different time of day or – better yet – a different branch.

Get online, but let me repeat – NO LEGIT ORGANIZATION IS GOING TO TRY TO CHARGE YOU FOR GRANT OR SCHOLARSHIP INFORMATION. You’re better off trying to help out that Nigerian Prince if you insist on being careless with your financial and personal information online. Instead, try the U.S. Department of Labor’s free scholarship search tool. Search the name of your state plus the words “grants and scholarships.”

Ask your parents to check with their employers. The bigger the company, the better the chances they have some sort of aid available. If you’re working, check with your employer. Even companies like McDonald’s are advertising their willingness to help with tuition for their employees Although, it’s probably safe to assume there are some strings and limitations attached.

But that’s OK because your goal at this stage isn’t to accept or refuse anything – it’s to gather options and information. Remember, you’re the Magical Grant and Scholarship Locator. By which I mean, you’re putting in the time and effort to find grants and scholarships to help you figure out how to pay for college.

Finally, ask yourself what “groups” you might belong to. Any demographic outside of “generic straight white able-bodied male” has organizations and advocates scattered across the country, many of whom offer small grants or scholarships for those who qualify. Now, you may be the sort who doesn’t like to see yourself as a member of this group or that. Maybe your politics or personal preferences are such that you don’t want to “play that card” for personal gain.

With all due respect, in this case, you need to get over that and apply for the grant or scholarship. The best thing you can do for yourself, your “group,” your community, family, state, or nation, is getting that education and be all you can be personally, professionally, and financially. If that means that for once in your life you have a chance to exploit the fact that you’re a one-legged transgendered Czech-Irish Buddhist, then go for it.

Don’t worry, we’re not going to think less of you for claiming that $400 stipend from the local chapter of similar folks.

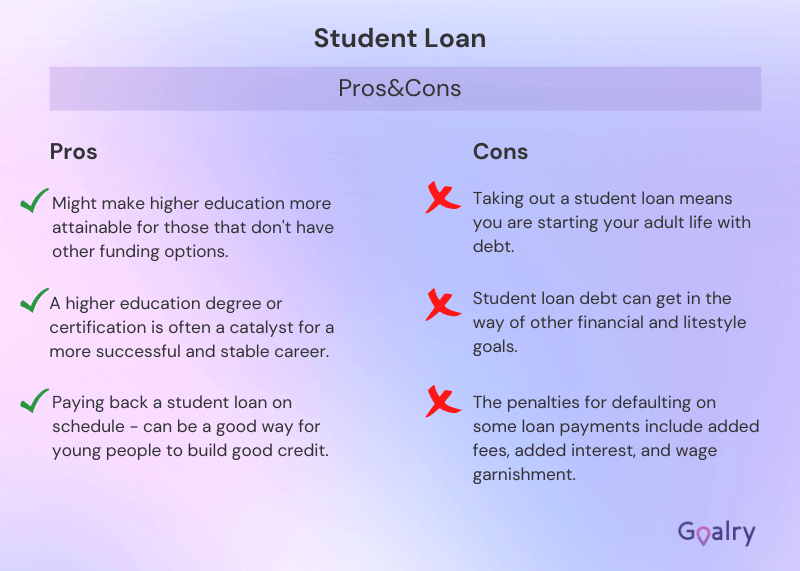

Student Loan Shopping

They’re everyone’s absolute last option for how to pay for college. That’s not entirely fair. Student loans are a necessary option for the many college students, no matter what their age range or where they’re attending. And if you learn how to save money on a student loan, it can be a really good option for you. But let’s look at some other possible answers for how to pay for college first, then come back to them.

Traditional student loans (the ones offered through the federal government) have several advantages:

- Fees and interest rates tend to be lower than what you might otherwise qualify for.

- Your credit score is not a major factor in determining whether or not you qualify.

- Repayment is often deferred until graduation or sometime thereafter.

- Repayment can be tied to your income, so the less you make, the less your payments.

- There are sometimes options for “debt forgiveness” if you work in certain professions or specified geographical locations.

Now, I’m about to talk about some other options for how to pay for college, or at least how to pay for part of your post-secondary education in other ways, should you so choose. That doesn’t mean I’m against student loans. As with any loan, I merely suggest you pay attention to the details. And don’t assume anything about the terms or your ability to repay without taking some time to consider all of the possibilities.

I’m not interested in telling you WHAT to do, my friend. If you’re about to enter an institution of higher learning, you should be able to do student loan shopping, gather information and consider your options. Then decide for yourself how to pay for college, yes?

A personal loan is your most basic sort of loan. You borrow a specific amount for a set length of time. And agree to an interest rate and a structured, predictable plan of repayment. The terms you’re able to secure are largely driven by your credit history and three-digit credit score. Although, your current income and anticipated employment may play a role as well.

If you’re pursuing post-secondary education other than that offered in a traditional four-year university, a personal loan for students might be a helpful option. Not all forms of training or education qualify for traditional college loans, or the amount may be modest enough that you’d rather tackle it like any other financed expense. I’m not pushing this option for everyone. But depending on your circumstances, it might be the simplest and most obvious solution.

This is an arrangement you make directly with your school of choice. Rather than borrow money for tuition with specific terms guiding repayment, you commit a percentage of your future income to the school instead.

The flexibility of the income share agreement is obvious – if you end up with a strong income, the school gets paid back quickly. If you don’t make as much as you’d hoped, your repayment is based on a percentage of that rather than the amount you actually owe. Typical ISA agreements are tied to a length of time rather than a dollar amount. So if you agree to give the school 7% of your income for ten years, you might end up paying way less for your education (if things aren’t going well) or double what other students pay (if your career takes off).

Most financial experts aren’t in love with ISAs. Do some research and make up your own mind before considering this option.

The answer to how to pay for college is almost never “Use a credit card!” That doesn’t mean, however, that responsible credit card use can’t be a part of your plan for incidental expenses as you pursue your education.

Keep in mind that while credit card companies aren’t necessarily evil. They do have a vested interest in “hooking you” early. And start you along the path of eternal repayment without ever being repaid. Don’t just assume you know all there is to know about credit cards for students and fall into the trap of going to either extreme – careless use and irresponsible debt or absolute refusal to carry any form of plastic.

College, among other things, is about learning to adults. Responsible credit card use is part of Adulting 101. With great power comes great responsibility. And learning to use revolving credit responsibly gives you financial power and stronger long-term credit.

Conclusion

There’s no one answer on how to pay for college. Take some time and weigh your options, and above all else, DON’T GIVE UP. It can be a frustrating mess sorting through your choices and keeping up with everything, but guess what?

Welcome to college and the messy world of grown-ups. It may not be easy, but you’ll get so much better at it is difficult that you won’t even notice after a while.

Blaine Koehn is a former small business manager, long-time educator, and seasoned consultant. He’s worked in both the public and private sectors while riding the ups-and-downs of self-employment and independent contracting for nearly two decades. His self-published resources have been utilized by thousands of educators as he’s shared his experiences and ideas in workshops across the Midwest. Blaine writes about money management and decision-making for those new to the world of finance or anyone simply sorting through their fiscal options in complicated times.