Packing up your belongings and moving is often exciting. It means you are taking a step forward on your life path. It is also often an extremely stressful time. If your credit is bad, or you haven’t had a chance to develop your credit rating yet, you feel the stress even more. Moving can also be expensive. You have to deal with rents and security deposits, a moving vehicle, buying or replacing items that you may have to leave behind, and more. Getting moving loans with bad credit can also be difficult, especially if you don’t know where to look. You may start to wonder if the move is going to happen at all.

Planning Your Move

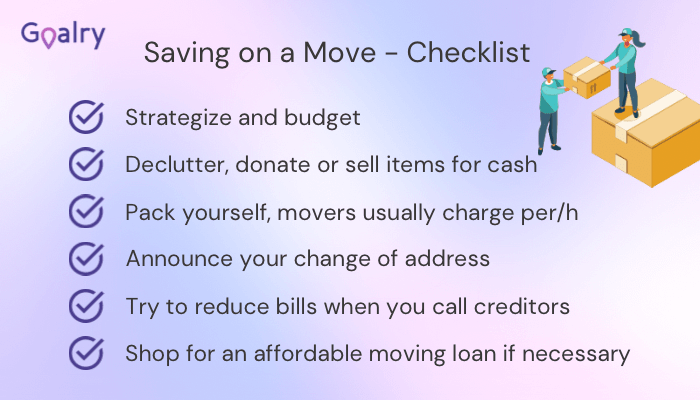

Before you do anything regarding your move, you need to sit down and plan everything out. You need to make a schedule, a budget, a list of everything you will need to do, pay for and have in the future. Let’s go over some things you need to keep in mind.

First, you should take a look at your credit report and start looking into ways in which you can start repairing it if you haven’t already done so. This will not only help you now but will help you in the future. By knowing your score, you won’t be hit with any surprises that could put a wrench in your plans. If you have enough time to repair your credit score, you will be able to get a better loan if you need to finance your move later on.

Start looking into places for rent in the area you would like to rent. Pick an area that you know you can afford easily. Your credit is bad? You are looking into moving loans for bad credit? Then you might want to have a fairly good idea of what amount you will be looking into seeking from a lender. As you work on finding your new home, think about how you will go about moving your things. Now that you’ve looked into preparing for financing a move, as well as your next residence, you need to plan the move itself.

What You Need for Moving

Will you use the help of friends and family? Or will you need to rent a moving van? Professional movers might also need to be considered if you don’t have help lifting heavy items. Make sure you look carefully into costs. Whatever you can do by yourself, such as packing, do it. Remember, movers usually charge per hour, so you don’t want to keep them working more than you actually need them.

Lastly, will you need to purchase any furniture or are you fairly well set on the basics? All of these answers will vary from one person to the next. Your answers will help determine how much money this move is going to cost you. They will also help you budget for the move. Let’s take a look at how you can increase your chances of finding a landlord that will rent to you with bad credit.

Should You Get a Moving Loan For Bad Credit?

Some people looking into moving loans for bad credit are concerned that adding another item to their credit reports will further damage their credit. This misconception comes about because every time someone checks your credit report, it is noted on the report and too many requests for credit in a short period of time can adversely affect your score. It isn’t likely, however, that you have had many such requests if this concerns you and you are trying to work at getting your score up. Qualifying for a loan can actually help you in improving your credit.

Let’s weigh pros against cons when taking out a moving loan for bad credit.

Pros

- Better rates and more affordable than credit cards.

- Get the funding quickly

- Take our larger sums of money.

- Fixed rates

Cons

- Going into debt

- Have to pay for fees

- High rates for bad credit

By now, you’re able to determine whether you need a moving loan, if it’s worth it for you and plan everything regarding your move and finances. But what about renting with a bad credit? Let’s look into it.

Finding a Place With Bad Credit

There are no shortage of apartments for rent at any given time. Winters are often the time of year when you find fewer options. That could be to your advantage, however, as most property owners don’t like leaving their places empty during the colder months. This may require them to get utilities like gas and electricity in their own names. Why? In order to prevent damage from the cold. There are other ways you can increase your chances of getting someone to work with you even with less than perfect credit.

- Consider making a deal to pay an extra month’s rent or increased security deposit. This shows the owner you are serious.

- Have someone with a better credit score become a moving loan co-signer. This way the landlord knows you aren’t the only one that he has to count on for his rent.

- Discuss the possibility of allowing the landowner to have each month’s rent automatically transferred from your account. This is often the one thing that works when nothing else does because they can count on the bank following through with the automatic withdrawals.

Saving on Short-Distance Moves

Before you look into moving loans for bad credit you should take the time to consider ways of reducing your moving cost. Mainly the cost of relocating your belongings from one place to another. There are numerous ways you can do this. Especially if your move involves a fairly short distance. This will normally be the kind of situation you are dealing with.

Paring down your belongings before the move. It will help save on packing materials and will reduce the amount of room required to physically move items.

Instead of investing in boxes available at movers and rolls of bubble wrap, stop by local stores. On the day they get their shipment just ask if they can save you some boxes. Liquor stores often have plenty of heavy boxes that won’t break easily. Use newspaper for wrapping breakables or wrap clothing or towels around especially delicate items.

Many times you can get a group of friends to help. It will usually cost you the price of a few pizzas and drinks.

It is possible, especially if you don’t have a lot of items, that it will cost less than a U-Haul.

If you have to rent a U-Haul or other moving truck, take time to look for someone else who may also be moving on the same day. Maybe you can work something out where you share the cost of the vehicle. Plus maybe you could help each other with loading and unloading. The day may end up being longer, but you will both benefit. Both with a reduced cost for the vehicle rental and physical help.

These are just a few of the easiest ways to save on a move across town. Now let’s look at some ways a long-distance move can be made less expensive.

How to Save on a Long-Distance Move

Moving long-distance, whether for a new start in life, a job, or a number of other reasons has become something that is faced by many families on an increased basis. In a country where mobility is so easy, it makes sense that people will find it logical to move across the country as quickly as they consider moving across town. Unfortunately, picking up and making this kind of move can be quite expensive. This is the kind of relocation where moving loans for bad credit are most often sought.

One of the biggest ways to save on a long distance move is to do as much of the moving activities as you can manage by yourself. Yes, hiring professional movers may end up being your most logical choice. Before you do, however, consider some of these ways to lower your costs.

Find free or inexpensive packing materials as you would for a short move. Plus have everything packed before the movers arrive. If possible, have someone on the other end to help unload the truck.

They come in a variety of sizes and at varied costs. Look around for the best deals. See if you can find coupons or discounts. Then try to work out deals for extra reductions for things like early booking.

When tax time arrives, you may be able to claim part of your moving expenses.

For example, books are heavy and take up a lot of room but the postal service offers very low rates for mailing books. You can save that space for other items and maybe reduce the size of the vehicle you will need or reduce the weight cost if you hire a professional service.

This is especially true if you hire professional movers. Try to aim for midday hours in the middle of the week. Also, avoid holidays and the beginning and end of the month as these are often times when the companies charge more. Finally, if you can plan your move for between September 30 and June 1, you may be able to save as much as 25 percent on your rental cost.

When you have bad credit to start with, you want to find the least expensive ways possible to make your move so you don’t get yourself into even deeper trouble. Moving long distance will more than likely cost more money than you have on hand. This is when you need to consider moving loans for bad credit.

Ways a Personal Relocation Loan Can Help

How can moving loans for bad credit help you? In addition to helping improve your credit score when you pay it back promptly, moving loans for bad credit can help in various practical ways. Consider you may have to pay extra money for rent or a security deposit when you move into a place. This isn’t money many people have just lying around.

The loan can help when you need help paying rent. Using moving loans for bad credit can also help you pay for a professional moving crew, rental on a moving van, and even replacing or buying things like a washer and drier or refrigerator if necessary. No matter how much we plan, there are always expenses that we missed in the planning stage. There are also times when things come up unexpectedly. You will have the extra money to take care of matters and not have to stress about a slight change in plans.

Getting one of these loans can also help you find peace of mind. You don’t have to consider depending on friends and family who may not like being like being put on the spot about loaning you money. Knowing you did this on your own will give you satisfaction. You also help get your life back on track after a poor financial break. Getting a personal loan for moving may be the one thing that gives you the opportunity to make a fresh start in your life. It may help you be able to accept that job offer in another state.

I want to get a moving loan – next steps

Now that your excitement about your coming move is in full swing and you have decided to look into moving loans for bad credit, how can you move forward? It is highly likely that if you simply walk into your local bank and ask for a personal loan they will deny your request, especially with bad credit. There are places, however, that are willing to take the chance on you. They are legitimate institutions and not some kind of Larry the Loanshark. Many of these are likely to charge a higher interest rate than your local bank, but that is to be expected when you have bad credit. You just need to find these companies and then choose which one fits your circumstances the best. That is where we come in.

Final Words

At loanry.com, we would love to be able to cut the red tape and give you the money you seek. Unfortunately, that is not what we do. What we do offer is one of the largest databases of available lenders you will find. We look over your information and then go through our database of lenders to help you find a lender who may be willing to lend to individuals with your credit history, current situation, and income level.

Yes, you could probably find one or two of these on your own, but all the time and legwork involved would add further stress to your situation. You don’t have to go to all the places that are more likely to give you a quick “no” and send you on your way. It is also highly unlikely you could find all the available resources without hours and hours of work. You have enough to deal with when preparing for a move that you don’t need the added hassle of tracking down a loan source. Let us help you find a moving loan for bad credit that will help you move forward in life.

Katherine Davis is a freelance writer specializing in the subjects of finance, banking, and investment. Based in New York City, Katherine’s experiences combating the Big Apple’s outrageous real estate costs and living expenses have provided her with some great budgeting insights on stretching a dollar. A graduate of Penn State University, Katherine advises millennials to be disciplined when it comes to their finances and to start investing as soon as possible.