If you have your own business and it is doing well, congratulations is in order. Many of us dream of being our own bosses, but few of us are able to achieve that goal. Also, a small business can be a tricky thing to keep running. There are many unique needs associated with small businesses. Many small businesses have a difficult time generating enough income to remain operational for longer than five years. As a result, you may need to find ways to keep your business solvent during tougher times. It happens to all businesses. You should have a plan in mind, just in case you find yourself in a position where you need cash quickly. There are many options available to you, one of them is accounts receivable financing.

What Is Accounts Receivable Financing?

Accounts receivable financing is a unique type of financing that doesn’t fall under traditional lending. It’s something you should understand when you are considering obtaining money for your business. This is potentially a way to gain access to money quickly. You may have heard of this type of financing referred to as invoice financing. They are the same thing, just called by different names. You may not have heard of accounts receivable or invoice financing, so I am going to explain the basics of it to you.

It is a special type of financing where a lender purchases any invoices that are outstanding. The lender, who is usually called a factor, gives you a percentage of the money that is due to you. They usually pay you anywhere from 80 to 90 percent of the amount of money you are expecting. I will explain it with a real-world example.

An Example

Let's say you manufacture clothes and you sent clothes to a buyer and you are expecting a payment of $10,000 from them. You are expecting that payment in a short period of time. A lender will give you 80 percent of that money, which equals $8,000 today.

However, you pay them the full amount of $10,000 that is owed to you. You are supposed to give the money to the lender when you receive it from the buyer. The lender does expect the payment from you within a certain period of time.

You can sell multiple accounts receivable items at one time to a lender. When you enter into one of these types of agreements, you should make sure that you review the fees and percentages to which you are agreeing. Even though you may feel like you need money fast, you should make sure you are comfortable with the agreement.

Different Ways To Approach Accounts Receivable

When it comes to business finance, accounts receivable financing can be one of the more complicated processes. I presented it to you in the most basic way above but you should be aware, it can become complicated. You should also know that just because you have money coming into you at some future date does not mean a lender is going to be willing to lend you money. The lender is still interested in your credit score when they lend money to you.

There are many different iterations of accounts receivable financing of which you should be aware. This is a sale of your assets. Anything that you have in accounts receivable is an asset and goes into your balance sheet as a liquid asset. When you sell these for cash, you are selling an asset. That is the most common type of accounts receivable financing. The good thing is that typically, once you sell the asset, the lender is responsible for collecting the debt. There is an exception to this, which I will discuss a little later in this article.

When you decide to finance this as a loan, your accounts receivable then becomes collateral. Your company maintains ownership of the accounts receivable because you did not actually sell them. You are responsible to collect on the debt.

Pros and Cons To Accounts Receivable Financing

As with anything, accounts receivable financing has positives and negatives. You must weigh all the options available to you when making a decision about how to fund your business.

Benefits To Accounts Receivable Financing

I am going to start with the benefits when you decide to use accounts receivable financing as a lending source for your business. One of the great features of this type of lending is that you do not need any form of collateral. It is considered an unsecured finance option. But you do not have to provide an asset to guarantee you will pay the money back to the lender. In many cases, a business loan does require collateral, or a long-standing business history, which many small businesses do not have before they need quick access to cash.

Another positive to accounts receivable financing is that you retain ownership of your business. You are selling an asset, but you are not selling any part of your business. You do not lose the ability to make decisions and you are not giving up future sales. The only thing you are giving up is the full amount of the money that is already due to you based on services rendered.

Disbenefits To Accounts Receivable Financing

This type of financing does result in higher costs for you. It gives you access to the cash you need quickly, but it does come at a cost. You must be sure you are prepared to pay the price. When you figure out the percentages, you typically will pay more money when you use accounts receivable financing over some other type of business loan. While you are necessarily paying out money, you are not bringing in as much money as you expected, so you do not have as much cash on hand. The lender is expected repayment within a certain period of time. If the money is not received within that timeframe, it may result in you having to pay more money in the long run.

You have to negotiate the terms of the contract that work for you. One of the pieces of the sale that you can negotiate is the length of time which you have to repay. It can be a short process or a long one. You have to negotiate a deal that works best for your business.

What Is A Full Recourse Clause?

When you opt for accounts receivable financing, there are two types of factoring that occur. Full recourse factoring tends to be the most common type of account receivable financing. This basically means that the lender may require a clause in the contract that states if the invoices are not paid by the customer within a set period of time, that your business has to buy back the invoices. That means your business has to pay on the invoices. Ultimately, that means you pay out more money in the long term.

Let me explain this in a different way. I will use a real example to highlight how this works:

In the example I used above, the invoice is for $10,000. So, you have created and sold $10,000 worth of product. The lender gave you $8,000, so you have already lost $2,000 in some way. The customer does not pay on the invoice and now you have to buy it back from the lender. However, you have to pay back $10,000 because that is what you have agreed that the lender receives. After that, it is your responsibility to go after the customer to get the payment that is owed to you.

Before you agree to this type of agreement, you should make sure you fully understand the amount of money for which you could be responsible. You should also make sure that if it turns out that you have to buy back the invoices, you will be in a position where you are able to do so.

What Is Non Recourse Factoring?

Another type of accounts receivable financing comes with non-recourse factoring. This means the lender, or factor, assumes all of the risks for your customers not paying on the invoices. Just because your agreement has non-recourse factoring, it does not mean that you are completely protected from a situation where the invoice is not paid. You should make sure that you completely understand any agreement that you enter with a factor. If you are not sure, then you should ask the question so that you know your responsibilities.

Some lenders only offer a non-recourse clause in the case of you filing for bankruptcy. However, you should know that just because your business ends up filing bankruptcy (if it does), you may not be protected from a customer that does not pay on the invoice. The lender may limit that type of protection only to those businesses that have good or better credit. If you have bad credit, you may not be given that protection.

The bottom line is you must be aware of the details of your agreement. This can be a confusing undertaking, so if you are not sure, you must ask questions to be sure that you understand.

Does It Make Sense For My Business?

An important question for you to answer when you are trying to determine how to finance a business is does accounts receivable financing makes sense for me and my business? You really have to take a look at the pros and cons to determine that. You also need to understand how much money you may have to pay in the long term and if it makes the most sense for your business. Even if you do not expect that the customer will not pay the invoice, you must consider and account for that. If you have to buy back the invoices, will you be able to absorb those costs? If the answer is no, you may want to question whether or not this is the best option for your business.

When you find yourself in a position where you need money fast, it is easy to focus on the immediate need and lose focus on what this type of financing means for you in the long term. Take a moment and a deep breath while you take a step back and look at the big picture. You may decide that this is the best option for your business. You may determine that the risk involved is worth it for you to get the money right now. Also, you may have more money in a month or two that if everything falls apart with the invoices, you will be able to buy them back.

Do I Have Other Options?

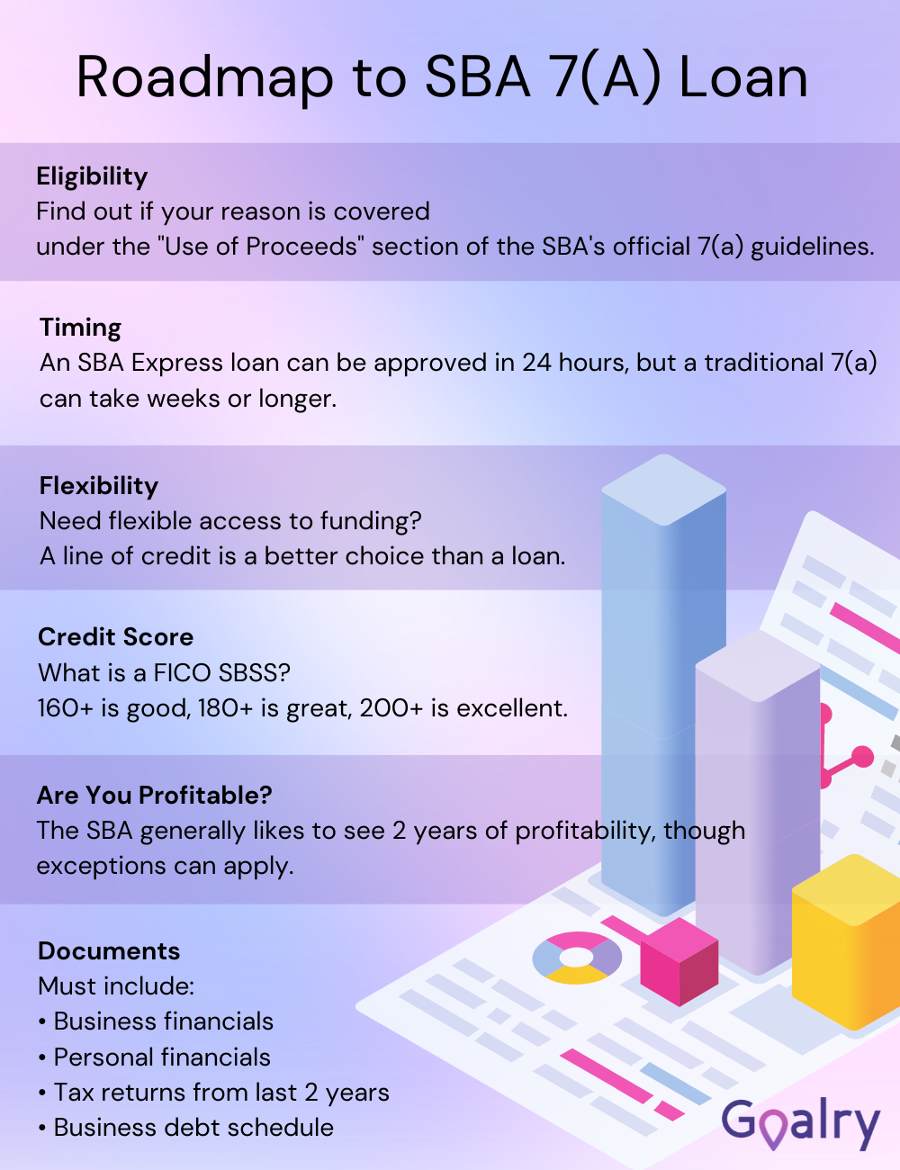

There are other types of business loans available to you as a business owner other than accounts receivable financing. It is smart for you to understand all of the options available to you when you make a choice between your financing options. One of the most available options for you is a loan that is backed by the Small Business Administration (SBA). They are a federal agency and they do not provide the business loan to you. They are backing the loan in the event that you default on it, they will pay as much as 90 percent of it. This makes your loan less risky. The SBA does work with traditional lenders in an effort to regulate the rules around the loans that they are backing. The SBA remains in control.

You should understand this type of loan is intended for long term planning and not meant to be a quick way to get cash. It is a lengthy process that requires a large amount of documentation. You may need to agree to background checks and provide financial reports and tax documents. In some cases, you may need to provide collateral. These types of loans can have fixed or variable interest rates. And the repayment period can be as long as 25 years.

Does It Matter What Type Of Business I Have?

There are different types of businesses that you may be an owner of which might make a difference as to which loans you may be able to obtain. It has recently been determined that almost a third of all small businesses have not had a requirement to borrow money. So, that means that about two-thirds of all small businesses have needed to borrow money. That is a scary proposition for anyone that owns a business.

Many businesses use a business credit card to help them acquire items that they may not have cash on hand to purchase. About 30 percent of those businesses borrowed money from a bank or credit union. 12 percent of those businesses received some type of credit from vendors. The reality is that no, it does not matter what type of business you have, there will come a point at which you will need to borrow money or have credit extended to you. You must be aware that a situation may happen and be prepared for it.

Conclusion

While at the core, this article is about accounts receivable financing, it is also about being prepared. One of the ways you can protect yourself as a business owner is to be prepared for what situation may occur and come your way. While it is impossible to predict how well your company will do in these difficult times, you can arm yourself with information about how to handle specific situations. I am not suggesting that you borrow money you do not need, or automatically assume you are going to fail. The economy is a difficult thing to predict. And if your business is based on selling a product or service, you may find yourself in lean times where customers are not purchasing your item. You should know what options are available to you if you should find yourself in that position.

You should also know that Loanry is here to help you at any time with all money matters, including finding lenders. We connect you with credible companies withing seconds.

Julia Peoples is a long-time business manager focused on providing decision making assistance to the public. She works with people at key points of their lives who are making important retirement and financial decisions. She has had many articles published that educate the public on sound financial decision making.

Julia writes for those who are working towards financial freedom or a better understanding of how finances work. She has shared her financial insights with individuals on a one on one basis for years.