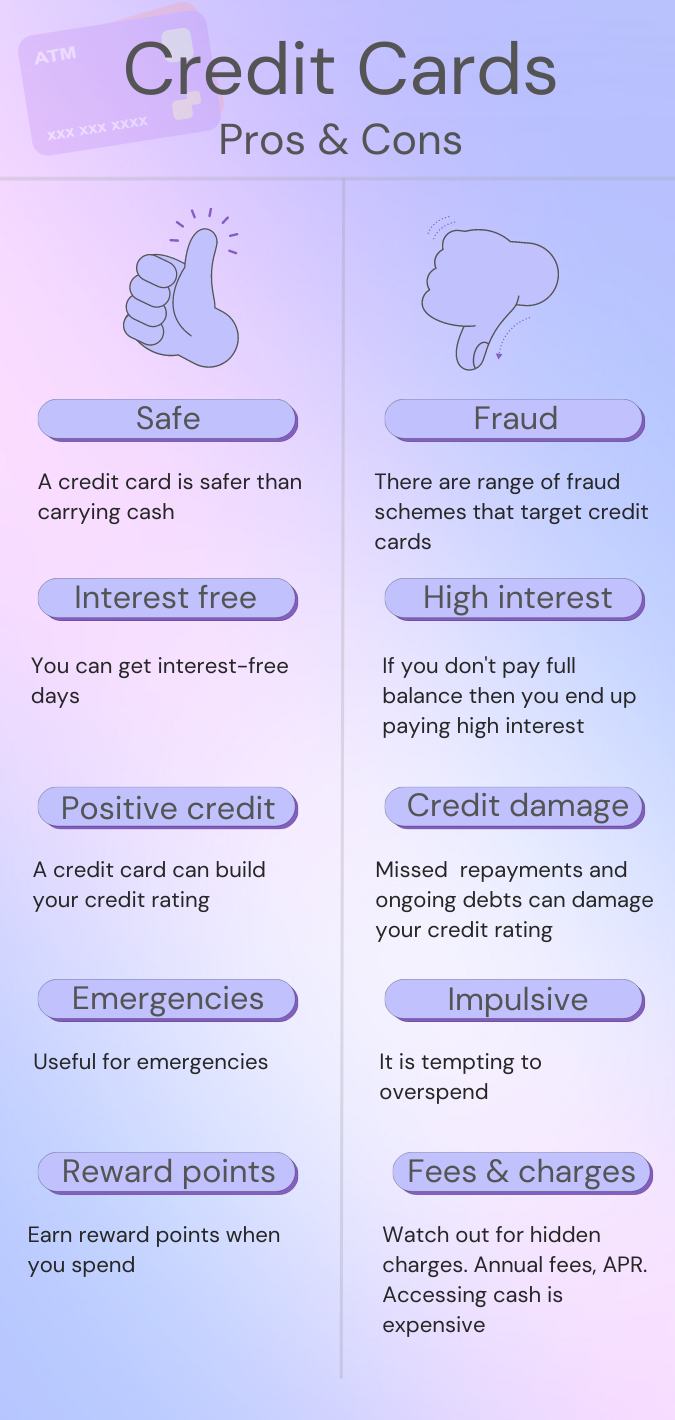

As with almost everything in life, there are both pros and cons of credit cards. Nothing is quite perfect. The question is do the pros outweigh the con? I do not think that the answer will be the same for each person, as everyone has a different financial situation, different characteristics, different strengths, and weaknesses. Therefore, anyone who is considering applying must understand the pros and cons of credit cards so they can answer that question for themselves.

Good and Bad Facts About Credit Cards

This article is a pretty comprehensive list that you can use to make credit card decisions. You may be in limbo about whether or not you should apply for one, and that is completely understandable. Some people do really well with credit cards while others are drowning in credit card debt. What is the difference between these people? It is usually that one group handles them responsibly and the other does not.

One advice

When looking for a credit card, make sure you do so by considering only reputable lenders.

Many times, the way a person treats a credit card is based on the knowledge of credit cards or the lack thereof. Knowledge is power, in my opinion, so understanding credit cards gives me more power over them than they have over me. Below is a list of the pros and cons of credit cards to empower you as well.

The Pros of Credit Cards

Ah, yes, the pros, aka the bright side to the cloudy day. When you are truly breaking down the pros and cons of credit cards, it is hard to ignore the following characteristics:

They are Convenient

Let’s be honest: a credit card can be one of the most convenient things ever. You can make purchases before you get paid, and you can purchase items online. You do not have to carry cash, so you decrease the chances of losing your money. And, it is so much quicker to swipe a card than it is to count out cash or write a check- yes, some people still do that.

They Provide Revolving Credit

Credit can have the capability of staying open forever, so long as you are paying the bill. If you pay your balance, it will be there the next time you need it, so you have an ongoing loan available. That is always nice, especially if you find yourself struggling around a certain time every month. If you get paid on the 1st of each month but find yourself need milk and gas on the 27th, you can use the credit card to get you through. Pay the balance when you get paid on the 1st and you will have it again on the 27th if times are tough again.

They Can Help Build Your Credit

Credit cards are a great tool for building your credit if you handle it responsibly. The best way to use a credit card is to have it cover small expenses or bills that you have the money for. Then, immediately pay it off. So, for instance, if you need $20 in gas and have the money on your debit card, use your credit card to pay instead.

When you get home, use your debit card to pay off the $20 on your credit card. This shows you using your credit but you still are not paying anything extra. There is a common myth that you need to let your credit card add debt in order for it to build your credit. That is very simply not true- your credit just needs to be used. And, in fact, the faster you pay the debt, the better it looks.

So, repeat that pattern of using your credit and immediately paying as often as you can. And do try very hard not to use it for something you cannot afford. Otherwise, all of your hard work will go down the drain, and your credit will be messed up instead.

Credit Cards Can Get You Through Tough Times- and Some Not So Tough Ones, Too

If you need gas before you get paid, a credit card can handle it. Emergency room trips and co-pays? Pull out your card. Impromptu date night? All you have to do is a swipe. Really, a credit card can help you through pretty much anything, as long as the amount is within your credit limit.

The Promotions can Be Awesome

Sometimes, you can find a credit card that offers 0% APR for 6 months or more. These promotions offer a great opportunity to make payments on a purchase without paying interest. I once worked in a mattress retail store where we sold some pretty expensive mattresses. (If you have not been mattress shopping for the last ten years or so, prepare yourself or you will go into sticker shock.)

This retailer is linked with a couple of finance companies, and they would often run promotions for 0% APR for 36 months, or 24 months. Once they offered it for a full five years. These promotions were awesome to me because I am a proponent of good sleep and good mattresses. The promotions gave me the opportunity to guide my customers to a much better mattress than what they could normally afford.

So, if you want to make a large purchase with a credit card, look for one that offers 0% interest for a set period. Doing this is really no different than putting it on layaway since you are not paying any extra. Just be sure you pay the money back before the interest kicks in.

Some of Them Offer Rewards

I am sure you have seen the commercials. Capital One offers great airline miles, Discover offers double cash back, and so on. Many credit card companies offer great perks for using their card. You might earn some free gas, or over time have enough cashback for a nice night at your favorite restaurant. The rewards may differ, but you should be able to find a card that offers you something you like.

The Cons of Credit Cards

I have always been told that you cannot appreciate the good things unless you know and experience the bad things. In response to that, we will now look at the second portion of the pros and cons of credit cards, otherwise known as the downs.

They are an Ongoing Source of Temptation

While those credit cards are there for you when you need them, they are also there for you when you don’t. For those who feel the need to spend money, having available credit lying around is too much of a temptation. When you are broke, it is easy to tell the difference between what you need and what you do not. When you have money to spend, those lines can get a little blurred.

If you know you will be too tempted to use your credit card, you need to take some precautions. Find a spot to hide it- just do not be like me and hide it so well that even you cannot find it. More so put it out of reach, and out of sight. Maybe you could put it in a lockbox or hide it behind a picture frame. Basically, anywhere that it is not so easy to grab yet easy enough you can get to it when you need it is a good place.

I cannot really remember when but some amount of years ago, there was a commercial about impulse purchases and credit card debt. The lady was standing in her kitchen when some ad came on her TV. She rushed to the freezer to get her credit card out- she had literally frozen her card. She went through a series of things trying to break and melt the ice before the commercial with the phone number went off.

Fortunately for her, she could not get to her card in time, and she could not see the numbers because the ice blurred them. This commercial still goes through my mind when I consider impulse purchases. While the ice was a drastic measure, it was also an effective one.

The idea behind this is that when temptation arises, you cannot immediately give in. You actually have to put in some effort. Hopefully, by the time you have got the card in your hand, you have decided whether what you are going for it is really worth it. Most often, you will probably find it is not.

Credit Card Payments are Another Bill

I hate bills. I hate them with a passion- as my granddaddy used to say, which always seemed a bit redundant to me since the definition of hate is actually passionate dislike. Anyway, I really hate bills. I, unwillingly, came to terms with the fact that some bills are never going to end. At least not unless I decide to live completely off of the land. If I already have to deal with the necessary bills that I despise, why would I want to add another unnecessary one? Though having a credit card in your wallet is not necessarily costing you, using it does.

The Interest- Need I Say More?

I probably don’t need to, but I will anyway. Though sometimes necessary, interest is never fun. Technically, it is money that you do not get to enjoy in any way. It is simply the fee you have to pay for borrowing the money. I understand why credit card companies charge interest. They are loaning you money and taking a risk in doing so.

What I do not understand is why consumers put themselves into a position to owe interest when it is not necessary. Using your credit card because your baby runs out of diapers or your power is about to get cut off is one thing. It may still not be fun but at least it is justifiable. Using that card to go to a Lakers game you cannot afford is just adding a bill. When it is at all possible, save the money for your purchase instead.

They Can Destroy Your Credit

We talked previously about the fact that credit cards can build your credit. Though that is true, they can also destroy your credit if you are not responsible to them. And this is a major factor when comparing the pros and cons of credit cards. Interest gets calculated and added each month to your bill. If you do not pay that interest and some of the principle, your debt will grow. The more money you owe on your credit card, the higher your credit utilization– which is something you do not want.

Credit utilization should be around 30% or less. If the interest on your credit card grows, your credit utilization could show as high as 100%- way above the sweet spot. If you must use your credit card, use as little of it as possible, and pay as much as you can.

Sometimes They Come With Fees

As if paying interest is not enough, sometimes credit cards come with additional fees. Some of these fees include annual fees, monthly service fees, late payment fees, return payment fees, foreign transaction fees, balance transfer fees, cash withdrawal fees… I will stop there but you get the idea.

You cannot judge all credit cards by the fees of another because not all cards charge fees. Those that do are adding to the bill. It is important to check terms and conditions for any associated fees and make an educated decision according to that information. If there are any fees attached, weigh that fee against the benefits of the card. I would not mind paying a $29 annual fee if I received $200 or more in cash back on groceries. Visit some online card shops, look into a few cards, and judge on a case by case basis.

Identity Theft is Easier with Credit Cards

There was once a time when every transaction was taken care of in-person and with either cash or some form of trade. Back then, it was hard to steal someone’s identity. Well, maybe it was not so much hard since someone could use your name. However, they could not clean out your bank account with a keystroke.

Even if they used your name and acted terribly across the nation, who would know? There was no way to track someone digitally so your boss would not run your name and find out you have credit issues. In this digital age, though, it is all too easy to steal someone’s identity and destroy them. Every time I turn around I hear about some new way that it is happening.

And credit cards do not help the matter. Do you know how easy it is for someone to skim credit card information off of gas pumps now? I think it says something about the state of our world that we need tamper indication seals on gas pumps. And worse, tech-savvy people, or just those with the right equipment, have to do no more than get close to you to transfer your credit card info to their device.

Online ID Theft Can Be Worse

So if you carry credit cards around, be cautious. When you make an online or mobile purchase, check-in the web address bar for the lock emblem- that tells you the site is secure. If that is not on the checkout page, back it up and find one that does. Also, if you choose to pay at the pump, check the seal. It is usually a yellow or red color and specifically says, “If this seal is broken, do not use and inform the cashier”.

The wording may differ from place to place, but it means the same thing. If that tape is broken, there is a really good chance that someone has tampered with the card reader. Anyone that is authorized to work on those card readers will have more tape to attach when they are finished.

Credit Cards Usually Have Very Confusing Terms and Conditions

The phrase “terms and conditions” makes my head hurt long before I have even looked at them. I love to read, but all of those tiny, dry words are not my forte. I just need straightforward, basic words. If a person has to read a sentence more than two times and use a dictionary to understand what the words mean, it is simply too much. It is even worse when you put the effort forward to read them only to be met with confusing terms.

Unfortunately, it is really important that you know them, so what do you do? You have a few options. The first is to get on the credit card company’s website and visit the Help section and the FAQs. The information you find there will probably tell you what you really need to know. You can even Google the card itself and see if there are any easy to read posts about it. Or you can call the credit card company and have someone sit on the line with you and break down the terms and conditions.

The Rewards are Sometimes Complicated, Useless, or Both

I love rewards. Who doesn’t? Rewards are awesome- well, they can be. A credit card that gives rewards definitely catches people’s attention, but what happens if they are rewards you care nothing about? If I have a credit card that gets me airline miles, it is wasted. Why? I will be honest- I do not fly. Nope, not doing it.

As many times as people have tried to talk me into it, I have not changed my mind. And, yes, they have quoted me the statistics about flying being safer than driving. Well, I happen to feel like I would survive a crash closer to the ground than I would with a plane plummeting towards the earth, but I digress…

The point is that if the rewards are not relevant to you, why would you care about them? Give me cashback on groceries. With a household of six to feed, including a teenager and two more kids that are almost there, I buy a lot of groceries. Earning some cashback from that would be marvelous.

Even worse, some rewards programs are so complicated, users have no idea what they even have. What good does that do anyone? If rewards are important to you, you can card shop for some that you can use and understand. If you do not care about rewards, just look for a simple credit card. There is no need for complicated if it is not benefiting you in some way.

Credit Card Debt Can Easily Get Out of Control

Like a fungus, interest just continues to grow and spread until credit card debt has taken over your life. Does that sound extreme? Sadly, it is all too real. That is why there are so many debt consolidation companies- they would not be popping up everywhere if there was not a market for them. And that market is bigger than people like to admit, and it is everywhere.

A week ago, I was driving down the road with the radio on, and suddenly a loud booming voice came over the speaker. A man was explaining that we do not have to have credit card debt and that we should call so this company could get us out of it. The commercial itself did not surprise me. What did is the fact that the guy specifically mentioned my area.

On a very real note, I live in a smallish town surrounded by even smaller towns. It is small enough that when I heard this commercial, I looked around wondering, “Since when do we have enough people living here to justify a target market?” I literally spent the rest of the day trying to determine how much money this company could make off of this little town. The answer- apparently enough for the company to dedicate resources to reaching out to us. Completely shocking.

On a serious note, though, debt is indiscriminate. It cares not about your age, religion, race, socioeconomic status, or whether you play quarterback in high school or playing the trumpet. It hits everyone. If you are not careful, it will knock you out of commission. All it takes is one missed payment or even one low payment, and it can take a turn for the worse. By taking the time to understand the pros and cons of credit cards, you are equipped to make wise choices concerning them.

One Last Word of Advice: Keep an Eye on Your Finances

Do not just pay your credit card bill when it comes in. Check it for any errors. The sooner you catch them, the easier they should be to fix. Also, look through your credit reports and check for any errors. If you see debts you do not recognize or addresses you have never used, or anything like that, contact someone immediately. The credit report should point you to the correct person to speak with about that charge.

After you have looked through the credit report, sign up for a free credit monitoring service. Your bank may have one you can use. If not, Creditry will alert you if there are any changes to your credit report. When you receive that notice, take a quick look to make sure it is something you did. You may not prevent someone from stealing your identity, but you can make it really hard and make them regret it.

Conclusion

I have always told my children that anything can be good, or it can be bad, depending on how you treat it. There are both pros and cons of credit cards. If you are responsible with a credit card, it can absolutely help you and open new doors for you. Those who are not responsible, though, will find themselves suffering. Yes, life happens and things go awry, but being responsible and making good decisions when you are in control is a big step in improving your financial state.

If you are still unsure about having a credit card, read over the list of pros and cons of credit cards again and imagine yourself in each scenario. Working through each, can you see yourself suffering or benefiting from them? Let the answer to that question guide your decision.

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.