Starting or running a business can be tough. Every step of the process can be a challenge, but perhaps none more so than getting the money you need to move up your business. The saying, “It takes money to make money” is true with all businesses. Even the simplest of businesses need things, so what do you do if you do not have the money to do what you need? Fortunately, there are lenders who are willing to loan you the money for your business. Unfortunately, finding the lender to do so can take some work.

Business Loan Brokers or a Direct Lender?

If you are trying to figure out how to finance a business, your head may be spinning with the available options, but we are going to try to help slow the spin. The first step you should take is choosing to work with a direct lender or going through business loan brokers. By the end of this guide, you should be able to make that decision much easier.

What Are Direct Lenders?

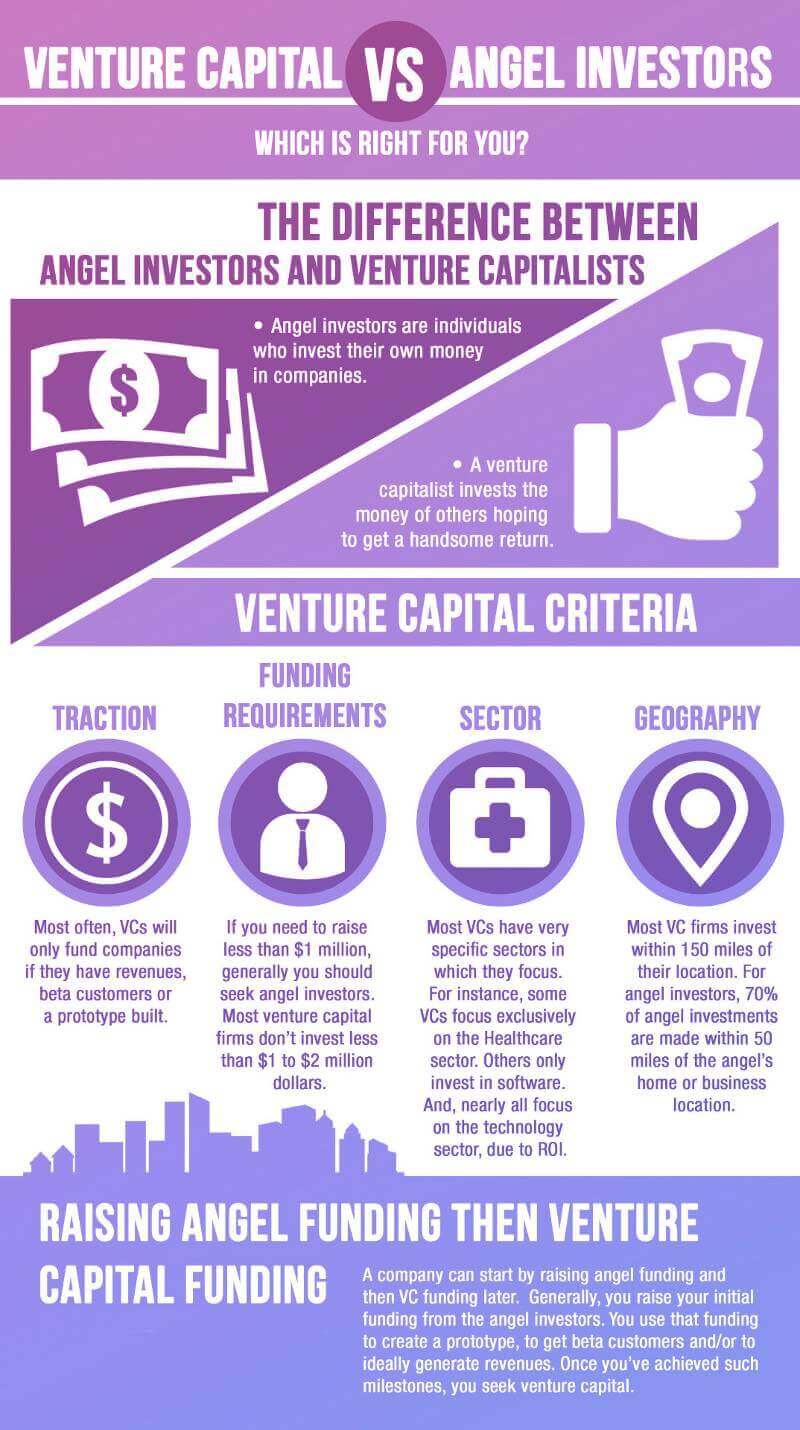

For the most part, direct lenders tend to be banks or credit unions. However, some direct lenders are not affiliated with banks at all. Direct lenders are lenders that loan you money directly from their own resources.

Let’s simplify. Let’s say that you need to borrow $1,000. You know Uncle Bob has it, so you go directly to ask him for the money. If you meet his requirements and agree to his terms, he loans you the money directly from his own pocket or bank account. This is a direct line between you and your lender.

Sometimes direct lenders have a small group of associates that they pool the money from or they even have avenues of crowdsourcing that they use, but they are not separate lenders. They are simply resources that your lender can tap into. The direct lender just uses them to gather the funds they offer to loan you.

Let’s take a look at the pros and cons of going through a direct lender:

Advantages

- There are no additional fees besides those that the lender charges. Unlike business loan brokers who charge an additional fee for their services, with a direct lender, you will only pay costs directly associated with your loan. Direct lenders can provide more favorable terms, lower interest rates, and even higher loan amounts to certain businesses.

- If you have an existing relationship with a direct lender, you just might have a leg up, so to speak. This is not always the case, of course. Some banks care not if four generations of your family have been banking with them. If you do not meet the requirements, you do not get approved. Others, though, take your existing relationship into account. Credit unions and lenders that do not belong to a big chain are more likely to work with you.

Disadvantages

- Direct lenders are usually not helpful for newer businesses, have a lack of credit history, or have no detailed plans to show. They are more apt to work with established businesses or those that can show profitability.

- They tend to require more paperwork and records. Between this and the need for a detailed business plan, preparing to apply for a loan with a direct lender can take a great deal of time- and give you quite a headache.

- You have to do your own research for each direct lender you decide to apply through. It can take a while to figure out what a lender requires and then get it together.

- Direct lenders usually do not have as many products as business loan brokers have access to. Direct lenders typically have one or a few loan types while brokers have connections with several products each.

What Are Business Loan Brokers?

Business loan brokers are more like a middleman. They do not loan money directly but rather cultivate relationships with and build a network of lenders. Going back to our previous example of Uncle Bob, let’s make this easier to understand.

We will say you still need to borrow that $1,000. The difference this time is that Uncle Bob does not have the money himself. However, you know that he is friends with a handful of guys that do. In this case, Uncle Bob would consider your situation- how much you need to borrow, how quickly you could repay, and so on- and determine which of his buddies will loan you the money. His buddy then becomes your lender while Uncle Bob is merely the avenue between you and the lender.

There is a good chance that Uncle Bob is going to want a little something for helping you out. He might just ask you to help clean out his garage. A business loan broker, on the other hand, will add a fee according to what you borrow.

While fees make some people run in the other direction, take some time to think about it first. Remember, the broker is handling pretty much the entire process for you, so of course, it is fair that they ask for a fee. The question is whether or not paying someone is worth it to you. If saving the time and preventing the headache is your priority, the fee should be worth it. Just be sure you ask how much that fee will be prior to signing any paperwork.

Advantages

- You do not have to research and find a lender for your business– the broker does it for you. Sometimes the hardest part of getting a loan is finding a lender because they tend to have their own requirements and application process. Business loan brokers know the lenders that are in their networks, so they know which lenders to apply for. They can also look at your financial situation from the get-go and determine who will and will not consider your application, saving you a load of time.

- Business loan brokers can prevent you from being scammed. Business loan brokers know the ins and outs of business loans, so they can spot a scam. Unless you are experienced in business loans, you may not.

- Business loan brokers do the work and the applying for you. You skip the headache and worry about other important matters while you let the broker handle his or her specialty.

Disadvantages

- Business loan brokers charge fees for their work. This is in addition to any fees and interest you already owe on the loan. The fee may be anywhere from one percent to 20 percent of the loan amount. On the positive side, they want to be sure they get their fees. This motivates them to find a loan with a lower interest rate so you can afford to pay all you owe.

- It could take longer than a direct lender, or it could be a lot faster. It really is hard to say and depends on the particular lenders involved. As mentioned earlier, your best bet is to ask all lenders or brokers you are considering how long the process typically takes.

Deciding Between Business Loan Brokers and Direct Lenders

If you are still trying to decide between business loan brokers and direct lenders, here are some questions to ask and some indicators to ask:

- Is your business new or still very young? Business loan brokers are usually a better option.

- Is your business more established with a decent financial industry? Do you at least have a business plan with financial projections? A direct lender may have better options.

- Do you need the money quickly or can you take a little more time with the application process? This can lean in both directions. Some say business loan brokers are faster since they have several lenders that they can work with. Others say that business loan brokers take longer since they have to choose between those lenders. The best way to know is to ask the business loan brokers you are considering and check any reviews you can find about that company.

- Is this your first business loan? Business loan brokers are worth a try.

- Do you have a relationship with a specific lender, such as your bank or credit union? You should consider trying them first. If they do not work out, you can always try other sources later.

- Do you understand loans and all of the jargon that goes with them? Business loan brokers can help you through the process while educating you.

Choosing Between Available Business Loan Brokers

If you feel that working with a business loan broker is the right option for you, here are some things to consider when choosing between them:

Ask how many lenders the broker works with. The higher that number, the better chance you have of being approved. If they only want to apply with one lender, you might want to back away. Only applying at one kind of cancels out the benefits of hiring a broker. The point of the broker is to look for the best loan product with the best rates and terms. How can they know which lender will offer you the best if they do not send your information to them?

If the broker insists on applying to just one lender, there is a good chance that the lender or loan they are pushing will provide them with the best benefits. And, we can be honest here, this is about you- not them. If they are not looking out for your best interest, you do not need to do business with them.

You need to find out just what happens to your contact information. If there are no privacy agreements, run the other way. You do not want your information sold to others. It is no fun having random calls from salespeople during dinner.

That is all not including the fact that selling your information to third parties makes you vulnerable to identity theft and hacking. If the broker does not protect your information, find one that does.

How much do they charge in fees? Are they transparent with those fees? If they are not upfront with you about the fees and the loan details, look for someone else. Most of the time, the fee will be a percentage of the loan amount. Therefore, they may not be able to give you an exact amount before hearing from lenders. However, they should be able to tell you upfront exactly what percentage they charge.

And sometimes the percentage changes depending on the amount of the loan. For instance, they might charge 10 percent for loans of $1,000 to $5,000 and 15 percent for loans between $5,001 and $10,000. That is no cause for concern. As long as they can tell you these percentages and the fee scale upfront, you are probably okay. It is when they try to evade your question that you should watch out.

If a broker guarantees that he or she can get you approved for a loan, it is a red flag. Think about it: How can they guarantee something they are really not in charge of? They are not the lender- they just help you find a lender. There is a chance that none of the lenders in their network will approve you for one reason or another. Legitimate brokers will not guarantee anything more than they will do their best for you because that is really all they can guarantee.

Almost- if not all- lenders require credit checks to approve you for a loan. If the lender does not, that is usually because they are secured with something like the title to your car or a check. If a broker says that they do not run your credit, it might be a scam.

I have known brokers that do not run credit checks at the beginning of the process. When clients first go in to speak to the broker, if the borrower can give the broker their credit score, the broker will get a pre-approval according to that instead of putting a hit on your credit too early in the process. Later, when it is time to actually apply, they run an actual credit check. They might not do it up front, but they do run a credit check at some point through the process. If they say they will not run your credit at all, it is probably too good to be true. Watch out.

Check any reviews you can find for the broker. The best references are those from prior customers. If you cannot find any references, you should probably stay away. You have to protect yourself.

Consider SBA Loans

One very reputable way to find a business loan happens to be the SBA business loan broker. These are loans that are guaranteed through the Small Business Administration, and they can often help many small businesses that cannot get funding through alternate means.

One very reputable way to find a business loan happens to be the SBA business loan broker. These are loans that are guaranteed through the Small Business Administration, and they can often help many small businesses that cannot get funding through alternate means.

Bad credit does not automatically disqualify you. The Small Business Administration is specifically intended for helping small businesses, and the organization is aware that not everyone has the qualifications to meet the stringent requirements of most lenders.

Again, specific loans may have additional requirements, but these are most of what the SBA requires for you to qualify for its help.

These loans can range anywhere from a few hundred to millions. The SBA can also often find you loans with low-interest rates and some with education to help you through growing your business. Be sure to check out the Small Business Administration for more information.

Conclusion

When you are trying to figure out how to finance a business, you can easily find yourself drowning in a sea of information. That is why it is good to start with deciding which avenue to go through- direct lenders or business loan brokers. Making this decision first can help minimize the amount of research you need to sift through and make a plan of action. There are also and online lenders for your business loan, where you can apply for a loan from your office or home. But about them, another time.

If you have a partner in your business, be sure to discuss this decision with them. And, as always, consider seeking professional advice if you feel it necessary. Your business’s future is too important to leave to chance.

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.