Credit cards are the holy grails of credit. They carry a lot of weight when it comes to credit scores and financial profiles. Every debtor should have at least one credit card on his or her credit report. Each debtor should also make sure that the credit card of choice is one that works best for him or her. There are many types of credit card options from which a debtor may choose. One of the most popular types of cards is the 0% intro APR option.

Best Credit Cards With Zero Percentage APR

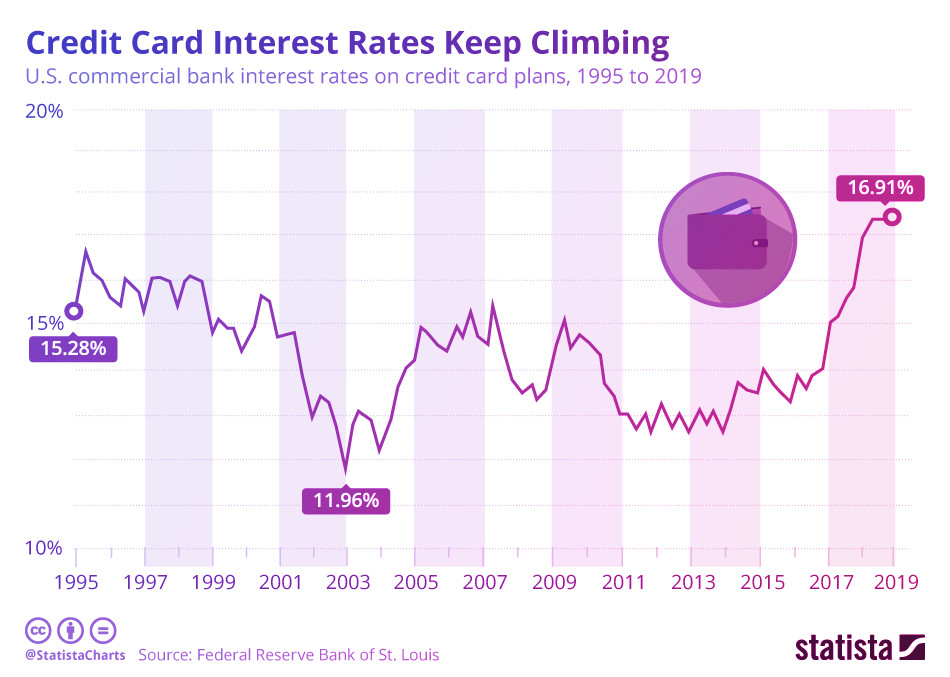

This credit card type has a promotion that offers the debtor 0% interest for a certain amount of time. After the promotional period ends, the debtor must pay the regular APR.

Consumers can take advantage of 0% intro APR credit cards in many ways. They can use them to merge their credit card accounts. They can use them to make large purchases without having to pay any interest. Also, they can use them to boost their FICO scores. We’ve taken the liberty to find some of the top 0% intro APR credit cards on the market right now that you should consider. Sift through this list and then pick the one that seems like it will suit your current needs. We can even help you find more.

Discover It Balance Transfer Card

The Discover It Balance Transfer card is a good choice if you’re looking for 0% intro APR credit cards that you can also use to transfer your balances. The initial 0% interest period is for the first six months for purchases and the first 18 months for balance transfers. After that, the annual percentage rate will increase to a 12.24% – 23.24% variable interest rate. This would be a great time to grab this card and transfer the balances from your other cards to it.

The Discover It Balance Transfer Card has other features and benefits to it aside from its promotional offer. You will also be free of paying any kind of annual fee because the current annual fee is $0. Other features that the card offers are features such as a free FICO credit score, social security number alerts, and friendly US-based customer service representatives. Furthermore, the card doubles as a cashback card. You can get up to 5% cashback on the purchases you make with the card. To make it even better, the credit card company will match your cash back earnings at the end of your first year. This card just keeps on giving!

To qualify for the Discover It Balance Transfer Card, you should have a credit score in the 700 point range. You should also be a US citizen who is at least 18 years of age, since you will have to sign a credit card contract.

Capital One Quicksilver Cash Rewards Card

The Capital One Quicksilver Cash Rewards Card is another card that may interest you. It’s one of the 0% intro APR cards that also doubles as a rewards card. The introductory period of having a 0% APR will last for the first 15 months of your purchases. After the promotional period ends, your purchase APR will change to a 15.24%-25.24 variable APR. Your balance transfers will also be at 0% for the first 15 months you have the card. After that, you will also have to pay a 3% fee.

The Capital One Quicksilver Cash Rewards Credit Card also has many other positive features that come with it. For one, you will not have to pay a fee for any foreign transactions that you do with your card. You will not have to pay an annual fee for this card either. Other features that you will have access to include features such as 1.5% cash back on all the purchases you make with your card. Additionally, you will also have access to a $150 bonus if you spend $500 on your purchases within three months after you get your credit card.

It’s worth taking a look at this card and thinking about applying for it. You must be 18 years of age and be a US resident. Capital One is generally more lenient with their approval criteria than some other credit card companies are. You may be able to get approval for this card if you have a credit score of about 670.

Discover It Cashback Card

The Discover It Cashback Card is another wonderful card offered to you by the Discover company. It is strictly a cashback card and does not offer balance transfers. Thus, it will be perfect for you if you’re not looking to transfer any of your balance. The Discover It Cashback Card allows you to earn 5% cash back on some of your purchases and 1% cash back on your other purchases. It also offers a cashback match as part of the promotion. You will receive a cashback match after the first year that you have the card.

This card is one of the 0% intro APR cards that will be a dream for you to own. Card features include features such as unlimited cashback, anytime redemption, Amazon checkout, and social security number alerts. Afterwards, the user would pay an APR of 12.23% – 23.24%.

You should have a credit score of at least 700 points to get approval for this credit card. As usual, you must be 18 years of age or older.

BankAmericaCard Credit Card

Bank of America is one of the most prominent banks in the nation, and it offers consumers a credit card with its name on it. The BankAmeriCard Credit Card has a 0% APR introductory period of 18 months. After the initial introductory period ends, credit cardholders will have an APR of 13.24% – 23.24% on purchases and balance transfers. They will also have to pay a 3% fee when they do balance transfers.

The Bank of America Credit Card has many features for consumers to enjoy. It offers clients free access to their FICO score so that they know how it’s improving each month. The card also has no annual fee and no penalty APR. Therefore, a late payment will not cause a rise in a cardholder’s APR. It may, however, create a drop in the person’s credit score.

Applicants must have a very good or excellent credit score to gain approval for the BankAmeriCard. They must also be at least 18 years old and be a citizen of the US. Applicants do not have to be Bank of America customers, but being a customer may help them to gain approval for the card.

American Express Cash Magnet

Some consumers are into American Express cards. If you’re like them, you will love the American Express Cash Magnet O% APR credit card. This card offers a 0% percent APR for the first 15 months on both purchases and balance transfers. After the initial promotion ends, the cardholder will have to pay an APR of 14.24%-24.24%, and it is variable.

This card is a cashback card, which means that cardholders can earn money back on their purchases. The card offers a 1.5% cashback potential. The promotional offer for this card also includes a $150 bonus for new cardholders who spend at least $1,000 during their first month of owning the card.

The cashback system allows cardholders to earn 1.5% cash back on every purchase they make. They can use the cash back to buy merchandise, get gift cards, or pay for their credit card bills.

Those two features aren’t the only features that this amazing card offers, however. Cardholders also have access to premium features such as no annual fee and the ability to use their cards in more than 3 million stores and websites.

American Express credit cards are generally hard to get. They require a credit score of 700 points or more for approval. A credit score of 700 or more is considered good or excellent. Card applicants must also be at least 18 years of age to apply. They can make their applications over the phone, or they go to the website and apply online. Sometimes, American Express sends offers to potential cardholders. A consumer can follow an invitation and visit the required site to apply for a card that way. Approval should be quick and painless.

Chase Freedom Card

Chase Bank offers the Chase Freedom card to consumers who have scores of 700 to 750 points. The Chase Freedom card has an introductory period of 15 months where cardholders do not have to pay any credit card interest on their purchases. After the initial 0% APR period ends, the cardholders will have a regular APR of 15.24% – 23.99%. Along with the 0% APR in the beginning, the Chase Freedom card gives a new cardholder a bonus payment of $150. The person has to spend at least $500 during the first three months of account opening.

The Chase Freedom card offers a myriad of additional benefits. One thing they offer that’s different from other credit cards is weekly access to the cardholder’s credit score. The Credit Journey feature keeps cardholders abreast of how they measure up in the credit world. Some of the other features that this card has to offer include features such as 5% cashback on certain categories up to $1,500 and unlimited 1% cashback on all other purchases. Cardholders will also get to enjoy a 3% introductory balance transfer fee and no credit card annual fee at any time. This one is worth a try if you have a good credit score, and you want to take advantage of some huge cashback opportunities.

Capital One Savor One Credit Card

The Capital One Savor One Credit Card is definitely a card that you can savor. It comes in a cute little peach color and a memorable name. It’s one of the 0% intro APR cards that you can get if your credit score is not in the “excellent” category. You may be able to land this card if you have a score of 660 or even a little less. You can certainly give it a try if you don’t have too many inquiries on your credit report at this time.

The 0% APR on this card lasts for the first 15 months after you open your account. You will have a 15.24% – 25.24% APR when the first 15 months of time goes by. You can still enjoy a myriad of features even after the initial promotional period ends. One feature that you’ll be able to enjoy is the $0 annual fee. It’s always a pleasure not to have to worry about an annual fee hitting your account when you’ve forgotten all about it.

This card will also not charge you for any foreign transactions you conduct while you’re traveling. Your cash rewards are perhaps the best part of card ownership. You can earn 3% cashback on all of your dining and entertainment ventures. You can also earn 2% cash back on your grocery shopping. You’ll get 1% cash back in every other category, and there will be no limit to the amount that you can earn. Additionally, the card company will give you a $150 bonus if you spend $500 on the card in the first three months that you have it. That sounds like a deal that you shouldn’t ignore.

Capital One Venture One Rewards Credit Card

Capital One offers quite a few credit card options to the masses. The Venture One Rewards Cards is yet another card that gives you a lot of perks and no hassle. It offers an introductory 0% APR for the first 12 months that you own the card. The difference between this card and other cards is that it also offers points that you can use for traveling. You’ll earn 1.25 miles for every dollar you spend on your purchases. You will also get a bonus of 20,000 miles when you spend $1,000 in the first three months that you have the card. 20,000 miles are equal to about $200 of travel.

This card has many more features for you to enjoy. For one, the regular APR is 15.24% – 25.24%, which is a bit lower than the ones on some of the other cards. You can also use your miles to travel whenever you want to travel. You won’t have to worry about blocks or blackout dates when you want to go somewhere.

This card also has no annual fee, no balance transfer fee, and no foreign transaction fee. That’s a lot of no’s for a credit card, and we think you should take advantage of that. Another “no” that this card offers is no penalty APR. You don’t have to worry about being punished for being late on your payment for one month. This might be an excellent card for you to try to grab. Consumers have rated it with four out of five stars on some of the top credit card categories.

Get Approved for 0% Intro APR Credit Cards

Those are just a few of the cards that you can qualify for that have a 0% APR introductory offer. As you can see, most of them have high FICO score requirements. Don’t fret if you’re not quite in the credit category to qualify. You can take several actions to increase your score so that you can get one of these great cards in your hand.

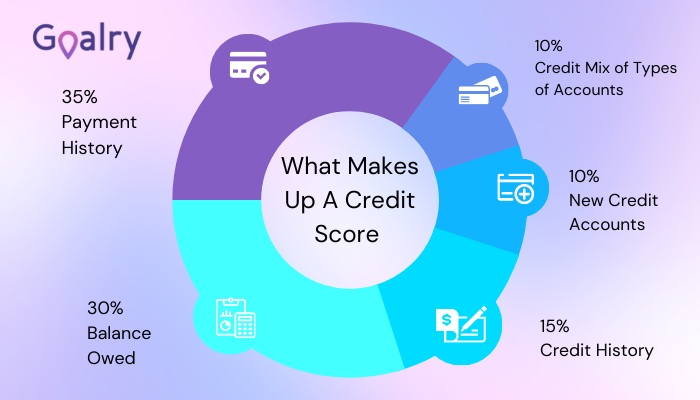

First, you should apply for an easy-to-get credit card with a low initial credit line on it if you don’t already have one. You can qualify for several unsecured cards. Once you get approved for one, you can use it to build your credit score up so that you can get approved for 0% intro APR cards in the future. All you have to do is make your payments on time each month and keep your utilization down below 30%. The credit card company will monitor your usage and payment history.

Your credit score will go up each month you make a timely payment and keep your utilization low. After a while, you’ll start getting offers from credit card companies you may have never heard of. You will be eligible for one of your favorite 0% intro APR cars as well. Work hard and continue to have faith. You’ll get to where you need to be soon enough.

Final Thoughts

You can start applying for 0% intro APR credit cards right now, and you can have one in your hands in about two weeks. You can also contact us and let us help match you up with a credit card that will be perfect for you. We are not a lender, but we are an advocate. We help consumers find a wide variety of financial products and services they need. Loanry can assist you in finding credit cards, consolidation loans, personal loans, car notes, and more. We can also help you get access to debt recovery products and services. Just reach out to us and tell us what you need. We’ll be delighted to help you grab hold of it.

Timiarah Spriggs is a personal finance writer who specializes in credit score growth and smart budgeting. She share budgeting, saving, and financial planning advice with various renowned finance shows, podcasts, and finance sites. Timiarah discovered the world of personal finance out of necessity. Her passion lies in helping consumers stay afloat in the world of finance and become masters of their profiles.