You’re getting married? Yay! Congratulations!

Some days in life are just more special than others: getting a driver’s license, graduating high school and college, welcoming your babies into the world, and your wedding. The day I got married was one of the best days of my life. Family and friends were gathered to celebrate our union, and I could not have been happier to say, “I do!” It was a magical night, but I want to tell you a secret: we spent less than $100 on our wedding. You read that right. Less than $100 for a wedding yet I had a dress, he had a tux, and there was a cake, flowers, a musician, a photographer, and a beautiful venue.

Smart Tips to Avoid a Wedding Loan

Getting married is something to celebrate. Going into debt for it is not. In fact, walking into a marriage with debt is a rocky foundation to start on, especially since the majority of divorces are due to finances. The fact that little sheets of paper can destroy a union is a sad fact, but it happens. So while you cannot prevent everything bad from happening, you can give your marriage a better chance at succeeding by avoiding debt as much as possible.

If you are considering taking out a loan for a wedding, pump the brakes. I doubt you would be reading this if you were not at least curious about how you can avoid a wedding loan. It is more than possible to have a beautiful wedding without going into debt. If you are committed to doing so, I am going to walk you through some tips so you can avoid a wedding loan. Grab a notebook and pen to jot down ideas as they come. Ready? Here we go.

1. Master Your Mindset

I am about to drop a bombshell that someone may want to scream at me for, but somebody has to say it. That feeling, that love you feel, the joy of the union- that is what a wedding is all about. It is not about a dress or a limo or anything else. It is about two people promising to love and cherish one another for life. That’s all.

Imagine that you are baking a cake. Mixing the ingredients and putting it in the oven is the process. That is the process that produces the cake. Icing or glaze is added and the cake is decorated. These additions make the cake prettier and may add some extra flavor but they are simply additions. The cake remains a cake whether it is decorated or not. The foundation is what matters, not the embellishments.

The same is true about a wedding. The union is what matters, not the embellishments. Don’t get me wrong, I love a big beautiful wedding, and if you can afford it, go for it. I just want you to remember what really matters on this day as you move through this process. Keeping that in mind will help while you work to avoid a wedding loan.

2. Talk About It

You and your future spouse should sit down and have a talk. What really matters to each of you on that day? This will be different for everyone, but if you had to choose the most important thing that you want at your wedding, what would it be? Keep these things in mind as you work on your plan. You should also decide on a budget together. How much are you truly willing to spend on your wedding? Agree to a number and commit to it. Do not forget the honeymoon, either. Maybe the two of you can agree on a lower budget for the wedding so that you can have a better or longer honeymoon.

3. Plan It

It is now time to begin the planning phase.

Get a Wedding Checklist

Trying to figure out what all you need to think about is anxiety-inducing. Everything is better and more clear if it is on paper, so look for a wedding checklist. You may find an eBook that contains one or you may find that surfing on the web. Either way, grab a checklist to help you stay on task. And then dream about everything you want! Imagine it, look for inspiration online, in magazines, everywhere you can find it.

4. Pare It Down

I hope you enjoyed the dreaming phase, but we have to come back to reality now. Do not fret, though. We are about to embark on a journey that will bring together your dream and your budget- as much as possible. If you are dead set on having an elephant to ride in on or an around the world cruise, I am not sure this will help. Otherwise, let us begin.

Gather Contacts

As you work through your plan, you should have a list of your contacts nearby as well as any specialties they may have such as baking or sewing, or even if one is a minister. This information needs to be handy.

Cut Costs

Most of the time when you hear this phrase, you are looking at a giant total that needs to be decreased. You are actually going to do the opposite- start with a bare bones wedding. As much as wedding planners and other professionals like to convince us that every single item on a checklist is imperative, it really is not. In fact, most of those things can be skipped if you choose to do so. Take the next four steps to start cutting down:

Now, take a look at your checklist. Which of the items on that list fit into the vision you already have? Which ones do not? Mark off the ones that do not- with a Sharpie. Once they are gone, pretend they were never there. Highlight the things that really matter to you- really matter. Now, mark off anything that is left because if it fits your dream, it would already be highlighted.

A very important note here: the only things that should be highlighted are things you and your fiancé want- not anyone else. Do not highlight things because it will make your mom happy or because your aunt Judy said you should. This day is about the two of you. If you have room left in your budget, you can add some things for others if you wish. However, for now, you are working hard to avoid a wedding loan. That is not going to happen if you do not keep your expenses down.

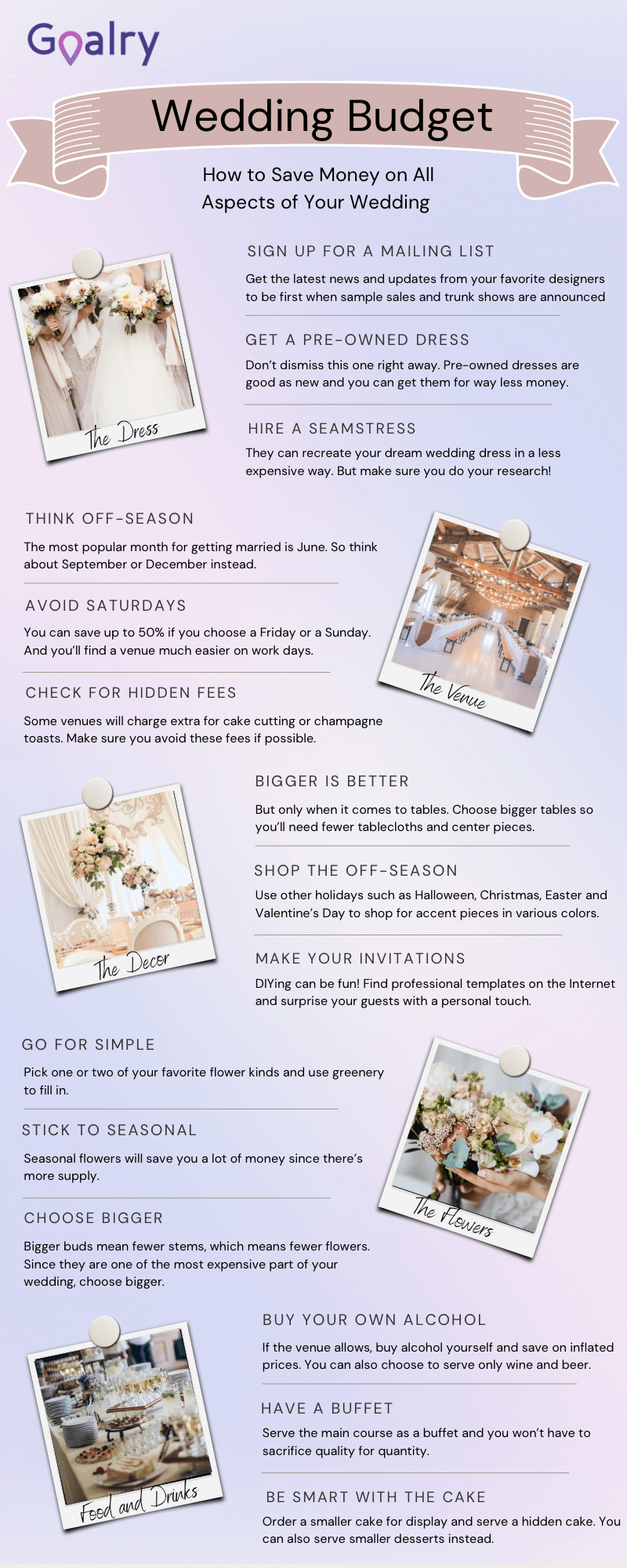

After you have your list down to the most important things, research the cost of those items. Does the total fit into your budget? If not, there is some more work to do. The following are some tips on how you can cut down on the remaining expenses so that you can avoid a wedding loan:

Your Resources

- Look at your list of contacts. Do any of those people have specialties that you could use, like baking cakes or making clothes? Maybe your brother’s best friend is a part-time DJ. Your best friend may be great at making invitations. Maybe your uncle is a minister or photographer. If you see any people with these types of skills on your list, highlight them. You might ask your mom or best friend if they know anyone who does.

- Talk to those contacts to see how much their services will cost you. Some may be willing to do what you need as a wedding gift. Some might trade their services for your babysitting or house cleaning services, or just give you a discount. Either way, you are likely to cut expenses tremendously in this area.

Your Guests and Reception

- Limit your guests. Do you really need 500 people in attendance at your wedding? Or even 100? Remember that you are feeding the guests, so how much are you willing to spend to do that? This is not about being selfish. It is about being smart.

- Get creative with the food you do serve. It is a wedding, a celebration. I have known people to even have barbecue sandwiches at their reception and all the guests loved it.

The Venue

- If there is somewhere special you want to do get married, call the location managers and ask them when the least busy time is to have a wedding. You will likely pay less when it is not in high demand.

- Do you have a friend, neighbor or family member that has a beautiful yard? Outdoor weddings are great, so consider asking to have the wedding there.

Your Look

Have you ever looked at the price tag of new wedding gowns? I have and it caused me to break out in a sweat. Wedding dresses can be ridiculously expensive, especially when you consider you will only be wearing your dress for a couple of hours on one day.

- Does a family member have one you can use? Ask them if you can borrow it, then dry clean it so you give it back to them in good shape.

- You might also save by shopping at consignment shops and second-hand stores. They tend to have wedding gowns fairly often and at very low prices. Often, second-hand stores and consignment shops will give you credit for bringing some of your own items in. Clean out your closet and use your credit for your dress.

- Take a creative friend with you. I happen to be the creative one in my group of friends, so when my best friend needed a dress for a ball she was invited to, I went shopping with her. At a second-hand store, she found a plain black dress that actually looked like a very casual dress, but I had an idea. We went to a craft store to get some jeweled beads and a few other accessories. The dress turned out great with everyone asking where she bought it, and she spent a total of $10.

- If you know a seamstress, like an aunt or grandmother, ask them to make your dress. You will then have even more control over how your dress will look.-Hair and makeup is another big area. Do you have a friend that is good at those things?

Those are just some ideas to get your thoughts flowing. Have a friend or your mom go over your checklist with you and brainstorm some ways you can save. After you have a complete list, make a budget and commit to it. Take the total amount that you need and divide that by the number of months you have until your special day.

The result- which is hopefully within your agreed-upon budget will be how much you need to save each month to pay for it all. If your total is $1200 and your wedding is in a year, you need to save $100 per month. Once you have this monthly amount, you know what to work toward. Remember your goal: avoid a wedding loan because those have pros but they also have cons.

5. Recruit the Dream Team

By now, you have at least an idea of who you want to recruit for certain tasks. It’s time to put them together to form your dream team. Finalize your list and book what you need as early as you can. The earlier you talk to them, be it a professional or a friend, the cheaper and easier it will be. And if you have a friend who is asking for more than your budget allows, do not feel bad about saying “no” to her. You are trying to avoid a wedding loan, not please everyone. You can always tell her your budget and ask if there is something she can do in that limit.

6. Work for It

At this point, you know what you have your planning and recruiting done. Your tasks are scheduled- if not, now is a good time to do that. You have done a lot, so take a breath and be proud of yourself. You know how much needs to be saved each month. If that is within your current budget, all you have to do is commit to saving it every month. If you are not really good at saving, get someone to help. Give the money to your mom, dad, or best friend- whomever you trust- put it away for you. They can then hold you accountable for saving it.

Some banks will even let you set up automatic withdrawals. You can tell them that you want a certain amount taken from your checking account at set times and that you do not want access to that money until a certain date. See if a bank in your area offers that option and put it to work if you can. No matter your method, be ruthless about sticking to your budget if you want to avoid a wedding loan.

7. Sweat for It

What do you do if the amount you need to save is outside of your current income? You work harder to get it. For example, I want to be in better shape physically but I am not good at forcing myself to do much. That is why I asked my husband to be my coach. He knows how to motivate me and how to push me when I would normally stop. He knows my limits so he keeps pushing until I reach them, and then he tells me to do two more. By the time our workout sessions are over, I am pouring sweat and sore. However, I start seeing results almost immediately. The sweat and tears pay off.

What does that have to do with a wedding? I am glad you asked. If you really want to avoid a wedding loan even with bad credit, you may have to push harder than you can imagine to get the money you need, and then go a little farther. Pushing and sweating for something is not easy, but the reward is great. The following are some ideas of how you may have to sweat more:

Side Hustles

- Pick up a second job, even if it is just a few hours a week. Deliver pizzas, wait tables, clean houses, babysit, walk dogs, wash cars, anything you can do for some extra money.

- Declutter your home, and your sister’s and your best friends and anyone else who will let you. Some people will let you clean out their homes or storage buildings for the items you find there. Gather it and have a huge yard sale. Your friends may even offer to clear out their own homes and help you with the yard sale. Make it a neighborhood yard sale if you can. The bigger the sale, the more attractive it looks. Be sure to advertise it, too, to maximize your number of customers.

- Grow a vegetable garden and sell the produce at your local farmer’s market.

- If you are artsy, make some jewelry, candles, or something similar and sell those items.

- Those who can type well can apply to transcription companies.

Cut Down Your Current Expenses

Cut the cable and use a streaming service like Netflix or Hulu. Take shorter showers. Turn off lights you are not using. Call around for better insurance rates. Trade your latte for home brewed coffee a couple of days a week. Have date night in your home or at a park instead of at restaurants and movie theaters. If you do go to the movies, go to a drive-in or to a cheaper matinee.

Apps to Try

There are apps that will earn you money. I have quite a few of them so I can say with certainty that the following three apps work:

- Receipt Hog- You take pictures of your receipts on your phone and they give you coins that you can redeem as PayPal cash when you hit certain amounts, starting at 1,000 coins.

- Ibotta– It is another receipt app that pays you cash at a certain amount.

- S’more– You actually do not have to do anything with this one except download it. It runs ads on your phone when you are not using it and you get points that transfer into dollars.

There are many apps out there to make some cash from that do not require much from you. None of them will make you rich on your own, but they can be a little extra money. There is no guaranteed amount, but I have made up to $200 in a year from the three without even being serious about scanning all of my receipts.

Shop Smarter

A few years ago, I started using Ebates and have earned a good deal of money for buying things I needed anyway. This is how simple it is: Ebates is similar to a search engine. If I need to purchase something online, I go to the Ebates app or website and search for that item. A list of stores show up that carry what I need, and I click on the store I choose. If I purchase something from that store at that time, I will get cash back from Ebates. The amount depends on how much that store is offering back at that time. When you shop, find the cheapest way to do it. Clip coupons, use sites like Ebates or Honey, whatever saves you money.

There are many ways to save and make extra money. It just takes some creativity and commitment, but it will pay off when you get to start your marriage without the burden of debt upon you. Remember, you want to avoid a wedding loan so you have to be ruthless when it comes to reaching your financial goal.

Just In Case…

There are times when you do everything you can and it is still not quite enough. If you find yourself close to your wedding date and you do not have the funds you need, do not beat yourself up. And do not call off the wedding- that is a bit extreme and all hope is not lost yet. Any amount that you cut out or saved is great so pat yourself on the back instead of feeling bad about it.

There is a last resort. I know you are trying to avoid a wedding loan or using credit cards, but if you have done everything else that you can, you may have no choice. The key is to make a smart choice here, too. There are many different types of loans available but not all will be a good choice. Some charge high-interest rates and have short repayment terms. You do not want to be on your honeymoon worrying about making that first payment soon after you go home.

Conclusion

If you must get loans for wedding expenses, go for personal installment loans first. They typically charge much less interest and have longer repayment terms. Additionally, the interest is usually fixed into the total amount borrowed and spread out over your full repayment loan. This is much better than taking out a loan for a wedding that has compounded interest.

You also need to be smart about who you borrow from. Not all loan companies offer the same terms and benefits. Look instead for a reputable company that can connect you with reputable lenders. They have the lenders they trust consolidated so it decreases the number of lenders you see to ones that match your needs.

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.